Summary

To ensure a successful bid while maximizing of profits, generation companies (GENCOs) need a self-scheduling strategy that can cope with a variety of scenarios. So distributionally robust opti-mization (DRO) is a good choice because that it can provide an adjustable self-scheduling strategy for GENCOs in the uncertain environment, which can well balance robustness and economics compared to strategies derived from robust optimization (RO) and stochastic programming (SO). In this paper, a novel mo-ment-based DRO model with conditional value-at-risk (CVaR) is proposed to solve the self-scheduling problem under electricity price uncertainty. Such DRO models are usually translated into semi-definite programming (SDP) for solution, however, solving large-scale SDP needs a lot of computational time and resources. For this shortcoming, two effective approximate models are pro-posed: one approximate model based on vector splitting and an-other based on alternate direction multiplier method (ADMM), both can greatly reduce the calculation time and resources, and the second approximate model only needs the information of the current area in each step of the solution and thus information private is guaranteed. Simulations of three IEEE test systems are conducted to demonstrate the correctness and effectiveness of the proposed DRO model and two approximate models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

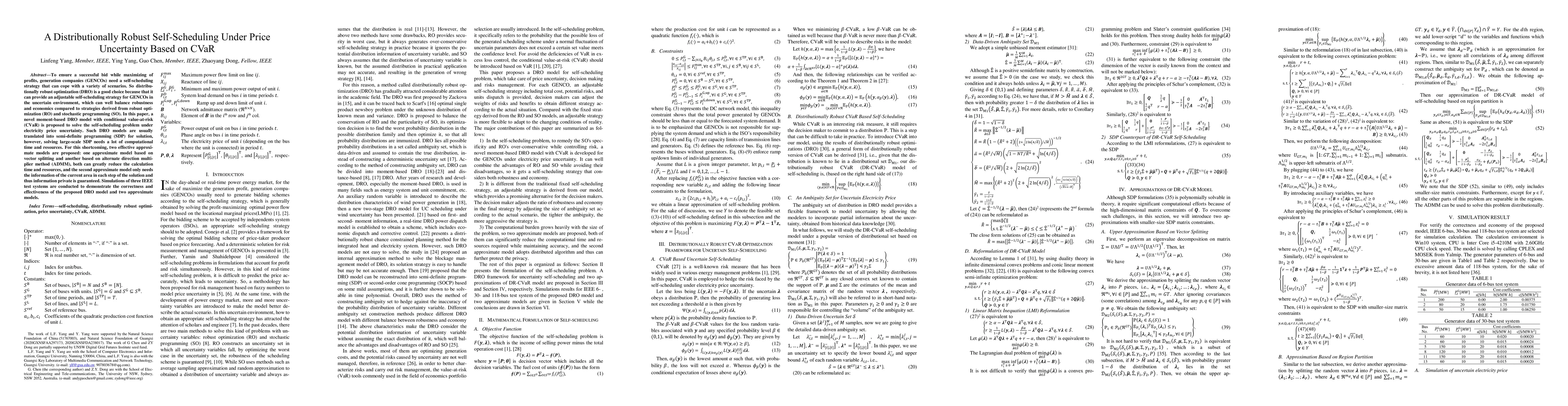

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA distributionally robust index tracking model with the CVaR penalty: tractable reformulation

Chao Zhang, Yaozhong Hu, Ruyu Wang

No citations found for this paper.

Comments (0)