Summary

Adverse selection is a version of the principal-agent problem that includes monopolist nonlinear pricing, where a monopolist with known costs seeks a profit-maximizing price menu facing a population of potential consumers whose preferences are known only in the aggregate. For multidimensional spaces of agents and products, Rochet and Chon\'e (1998) reformulated this problem to a concave maximization over the set of convex functions, by assuming agent preferences combine bilinearity in the product and agent parameters with a quasilinear sensitivity to prices. We characterize solutions to this problem by identifying a dual minimization problem. This duality allows us to reduce the solution of the square example of Rochet-Chon\'e to a novel free boundary problem, giving the first analytical description of an overlooked market segment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

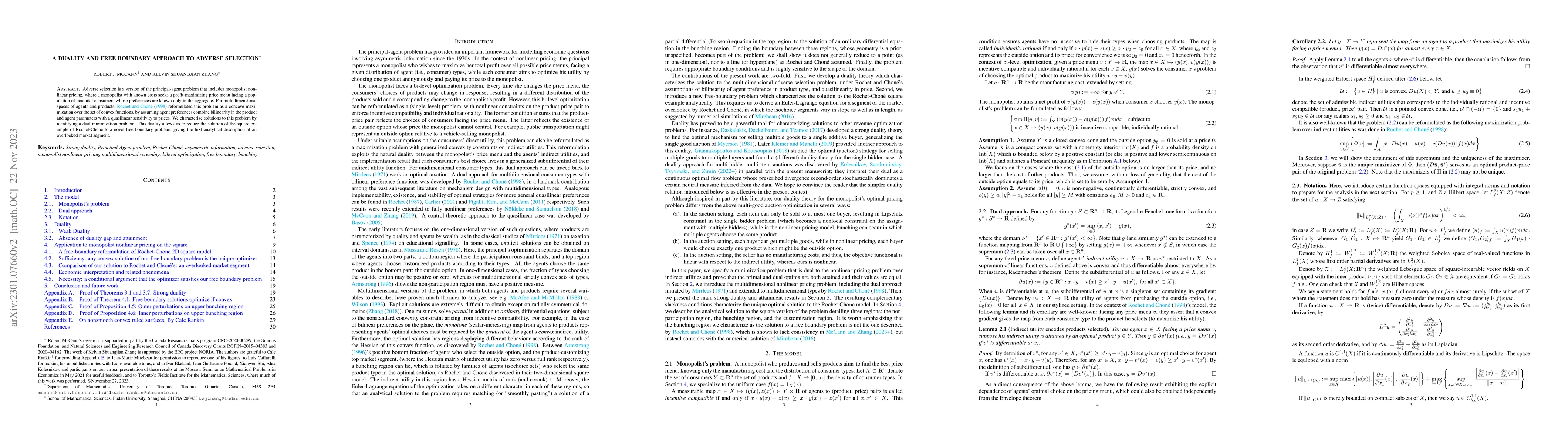

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)