Summary

At the core of insurance business lies classification between risky and non-risky insureds, actuarial fairness meaning that risky insureds should contribute more and pay a higher premium than non-risky or less-risky ones. Actuaries, therefore, use econometric or machine learning techniques to classify, but the distinction between a fair actuarial classification and "discrimination" is subtle. For this reason, there is a growing interest about fairness and discrimination in the actuarial community Lindholm, Richman, Tsanakas, and Wuthrich (2022). Presumably, non-sensitive characteristics can serve as substitutes or proxies for protected attributes. For example, the color and model of a car, combined with the driver's occupation, may lead to an undesirable gender bias in the prediction of car insurance prices. Surprisingly, we will show that debiasing the predictor alone may be insufficient to maintain adequate accuracy (1). Indeed, the traditional pricing model is currently built in a two-stage structure that considers many potentially biased components such as car or geographic risks. We will show that this traditional structure has significant limitations in achieving fairness. For this reason, we have developed a novel pricing model approach. Recently some approaches have Blier-Wong, Cossette, Lamontagne, and Marceau (2021); Wuthrich and Merz (2021) shown the value of autoencoders in pricing. In this paper, we will show that (2) this can be generalized to multiple pricing factors (geographic, car type), (3) it perfectly adapted for a fairness context (since it allows to debias the set of pricing components): We extend this main idea to a general framework in which a single whole pricing model is trained by generating the geographic and car pricing components needed to predict the pure premium while mitigating the unwanted bias according to the desired metric.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

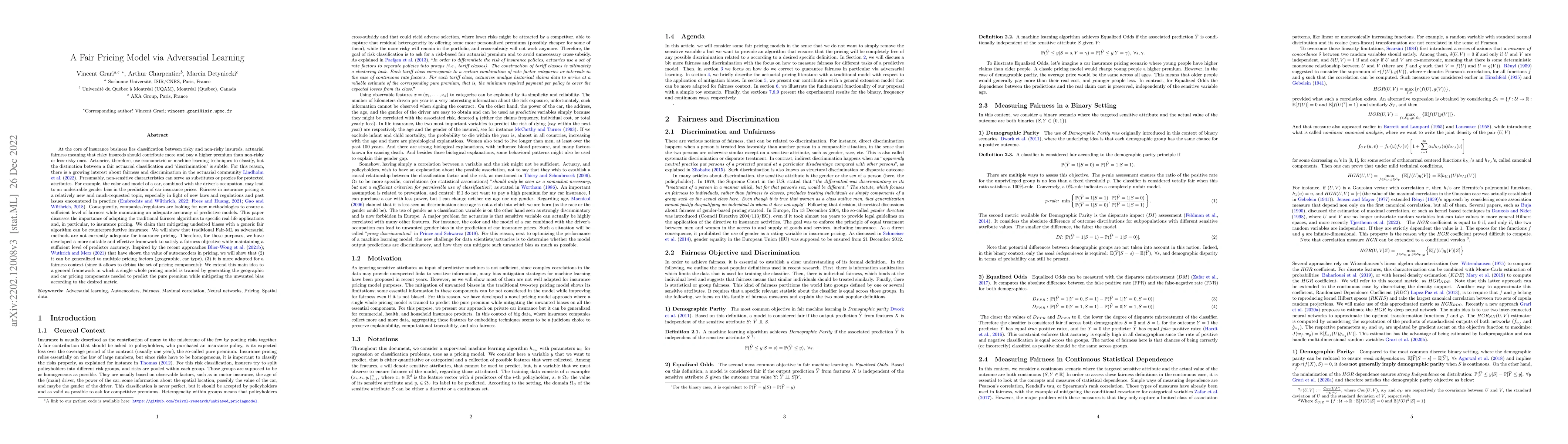

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFair Classification via Domain Adaptation: A Dual Adversarial Learning Approach

Canyu Chen, Kai Shu, Tian Tian et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)