Summary

We extend the Bipolar Theorem of Brannath and Schachermayer (1999) to the space of nonnegative cadlag supermartingales on a filtered probability space. We formulate the notion of fork-convexity as an analogue to convexity in this setting. As an intermediate step in the proof of our main result we establish a conditional version of the Bipolar theorem. In an application to mathematical finance we describe the structure of the set of dual processes of the utility maximization problem of Kramkov and Schachermayer (1999) and give a budget-constraint characterization of admissible consumption processes in an incomplete semimartingale market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

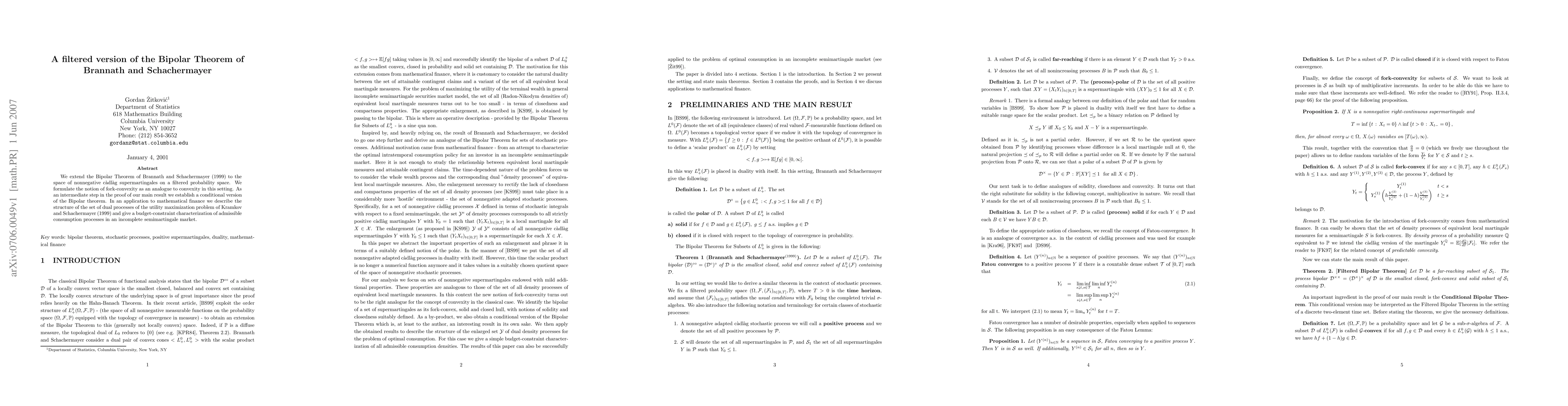

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)