Summary

In order to price contingent claims one needs to first understand the dynamics of these indices. Here we provide a first econometric analysis of the CRIX family within a time-series framework. The key steps of our analysis include model selection, estimation and testing. Linear dependence is removed by an ARIMA model, the diagnostic checking resulted in an ARIMA(2,0,2) model for the available sample period from Aug 1st, 2014 to April 6th, 2016. The model residuals showed the well known phenomenon of volatility clustering. Therefore a further refinement lead us to an ARIMA(2,0,2)-t-GARCH(1,1) process. This specification conveniently takes care of fat-tail properties that are typical for financial markets. The multivariate GARCH models are implemented on the CRIX index family to explore the interaction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

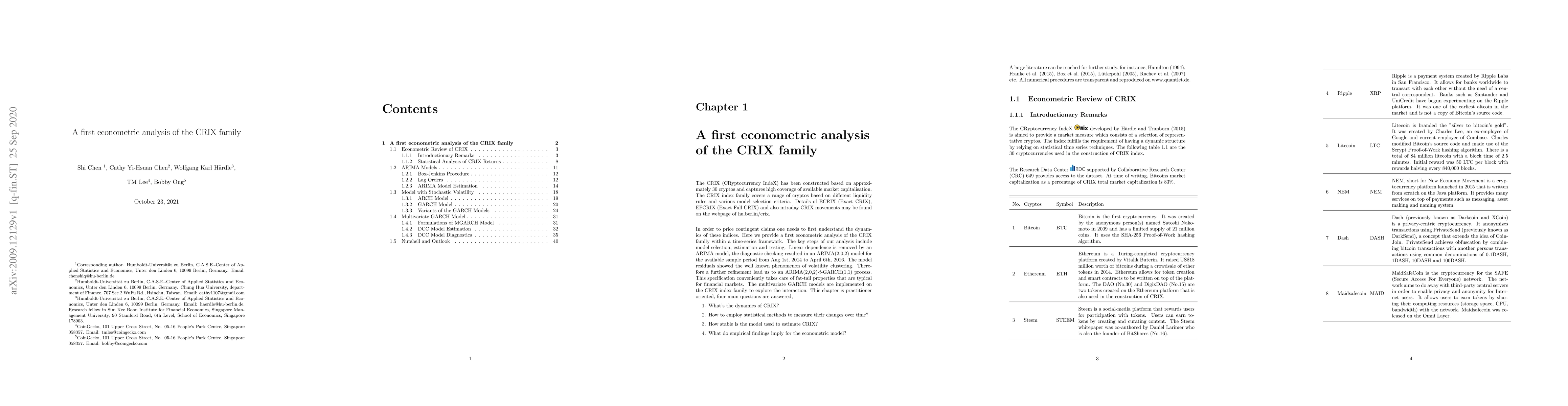

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)