Summary

One popular approach to option pricing in L\'evy models is through solving the related partial integro differential equation (PIDE). For the numerical solution of such equations powerful Galerkin methods have been put forward e.g. by Hilber et al. (2013). As in practice large classes of models are maintained simultaneously, flexibility in the driving L\'evy model is crucial for the implementation of these powerful tools. In this article we provide such a flexible finite element Galerkin method. To this end we exploit the Fourier representation of the infinitesimal generator, i.e. the related symbol, which is explicitly available for the most relevant L\'evy models. Empirical studies for the Merton, NIG and CGMY model confirm the numerical feasibility of the method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

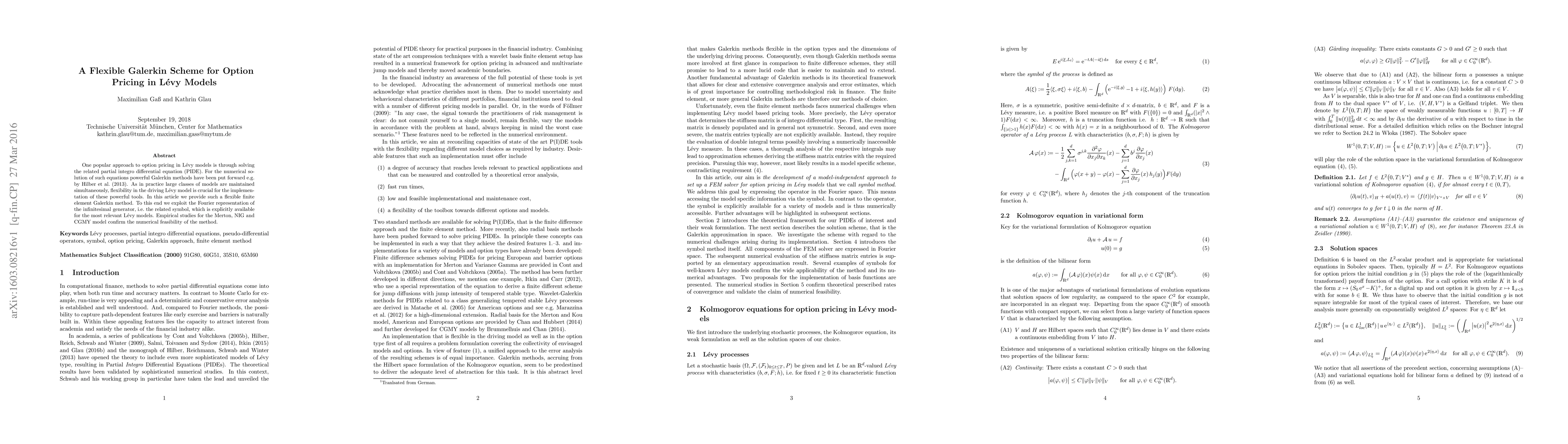

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)