Summary

Adaptive Monte Carlo methods are recent variance reduction techniques. In this work, we propose a mathematical setting which greatly relaxes the assumptions needed by for the adaptive importance sampling techniques presented by Vazquez-Abad and Dufresne, Fu and Su, and Arouna. We establish the convergence and asymptotic normality of the adaptive Monte Carlo estimator under local assumptions which are easily verifiable in practice. We present one way of approximating the optimal importance sampling parameter using a randomly truncated stochastic algorithm. Finally, we apply this technique to some examples of valuation of financial derivatives.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

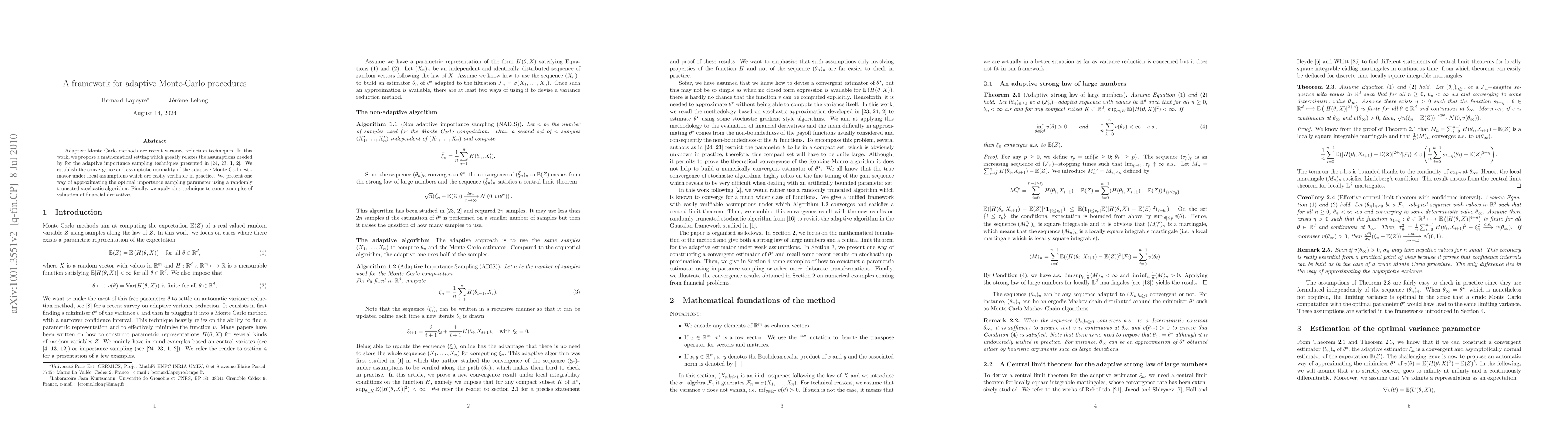

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)