Authors

Summary

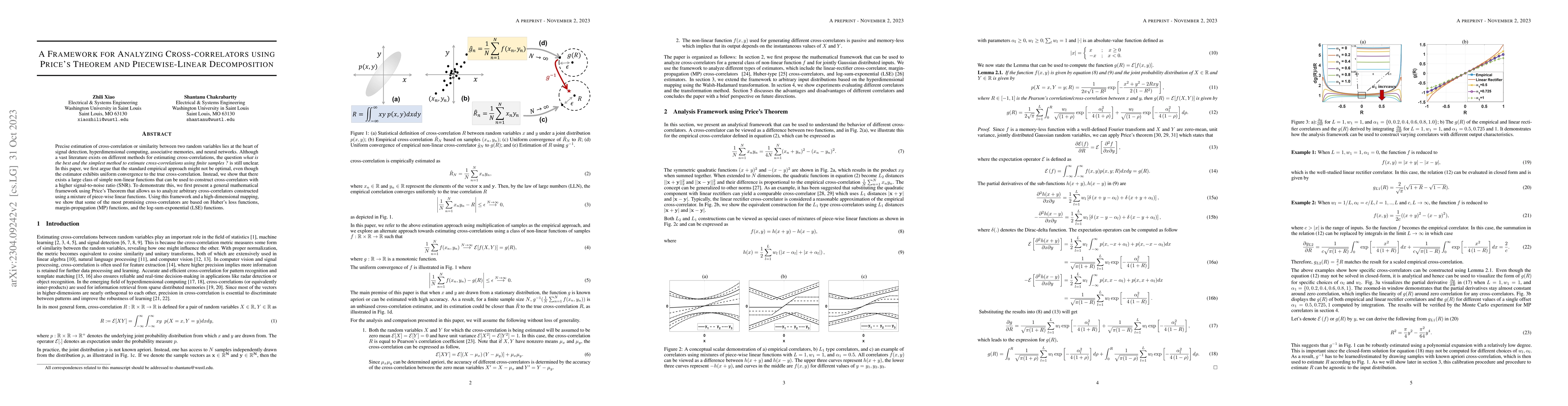

Precise estimation of cross-correlation or similarity between two random variables lies at the heart of signal detection, hyperdimensional computing, associative memories, and neural networks. Although a vast literature exists on different methods for estimating cross-correlations, the question what is the best and simplest method to estimate cross-correlations using finite samples ? is still unclear. In this paper, we first argue that the standard empirical approach might not be the optimal method even though the estimator exhibits uniform convergence to the true cross-correlation. Instead, we show that there exists a large class of simple non-linear functions that can be used to construct cross-correlators with a higher signal-to-noise ratio (SNR). To demonstrate this, we first present a general mathematical framework using Price's Theorem that allows us to analyze cross-correlators constructed using a mixture of piece-wise linear functions. Using this framework and high-dimensional embedding, we show that some of the most promising cross-correlators are based on Huber's loss functions, margin-propagation (MP) functions, and the log-sum-exp (LSE) functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDecomposition Polyhedra of Piecewise Linear Functions

Moritz Grillo, Christoph Hertrich, Marie-Charlotte Brandenburg

| Title | Authors | Year | Actions |

|---|

Comments (0)