Summary

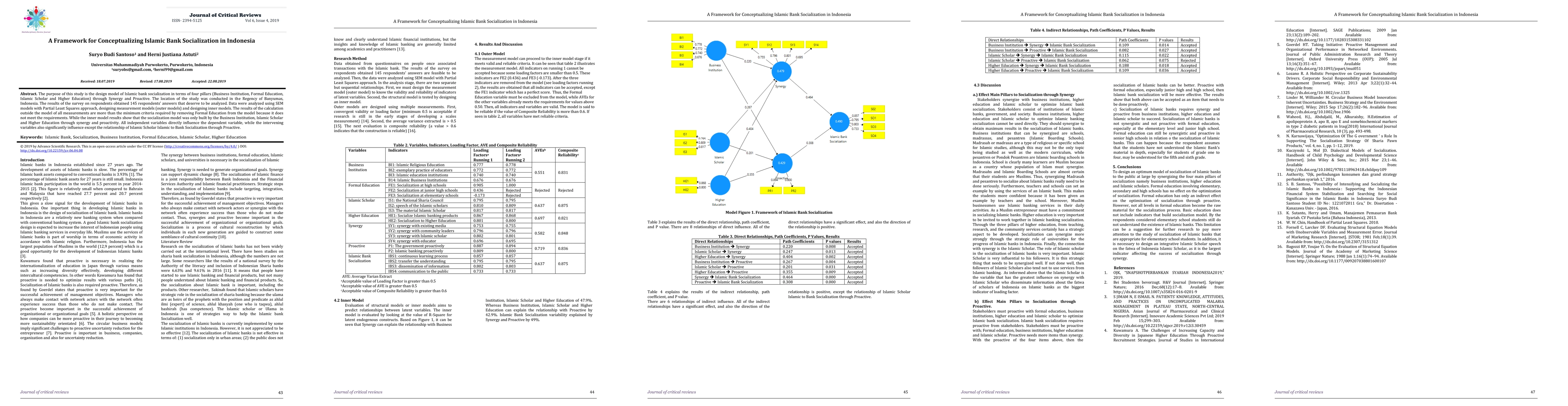

The purpose of this study is the design model of Islamic bank socialization in terms of four pillars (Business Institution, Formal Education, Islamic Scholar and Higher Education) through Synergy and Proactive. The location of the study was conducted in the Regency of Banyumas, Indonesia. The results of the survey on respondents obtained 145 respondents' answers that deserve to be analyzed. Data were analyzed using SEM models with Partial Least Squares approach, designing measurement models (outer models) and designing inner models. The results of the calculation outside the model of all measurements are more than the minimum criteria required by removing Formal Education from the model because it does not meet the requirements. While the inner model results show that the socialization model was only built by the Business Institution, Islamic Scholar and Higher Education through synergy and proactivity. All independent variables directly influence the dependent variable, while the intervening variables also significantly influence except the relationship of Islamic Scholar Islamic to Bank Socialization through Proactive.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInformal Socialization in Physics Training

Chanda Prescod-Weinstein, Apriel K Hodari, Shayna B Krammes et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)