Summary

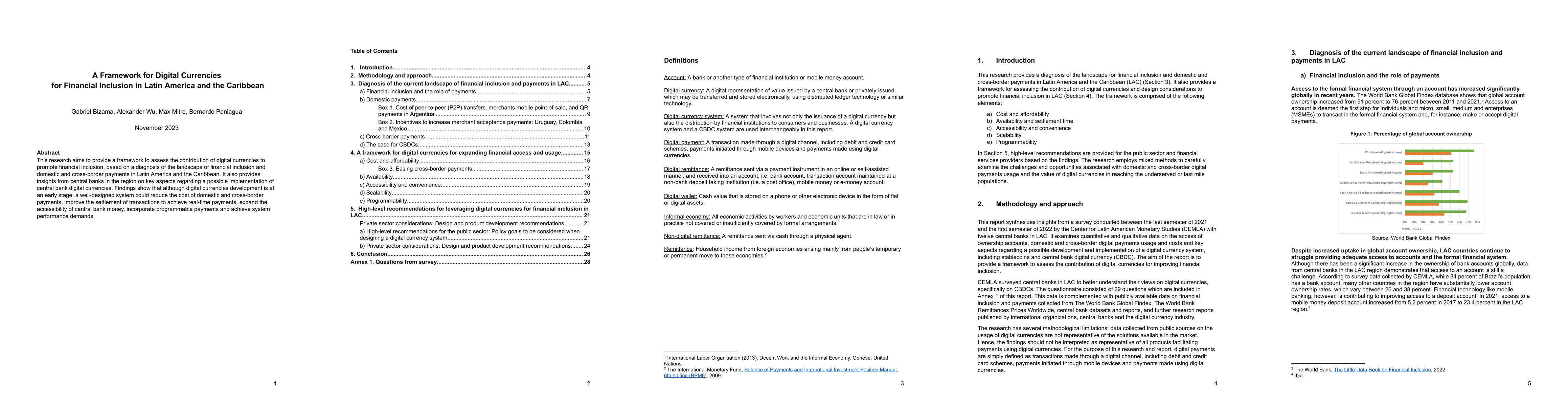

This research aims to provide a framework to assess the contribution of digital currencies to promote financial inclusion, based on a diagnosis of the landscape of financial inclusion and domestic and cross-border payments in Latin America and the Caribbean. It also provides insights from central banks in the region on key aspects regarding a possible implementation of central bank digital currencies. Findings show that although digital currencies development is at an early stage, a well-designed system could reduce the cost of domestic and cross-border payments, improve the settlement of transactions to achieve real-time payments, expand the accessibility of central bank money, incorporate programmable payments and achieve system performance demands.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData Enrichment Work and AI Labor in Latin America and the Caribbean

Saiph Savage, Maya De Los Santos, Gianna Williams et al.

Guideline Utilization in Oncology: Addressing Barriers and Facilitators in Latin America and the Caribbean.

Chavarri-Guerra, Yanin, Corrales, Luis, Morgante, James D et al.

Health-related SDGs in the national science agendas of Latin America and the Caribbean: a scoping review.

Ragusa, Martín Alberto, Tortosa, Fernando, Monteiro, Maristela et al.

No citations found for this paper.

Comments (0)