Authors

Summary

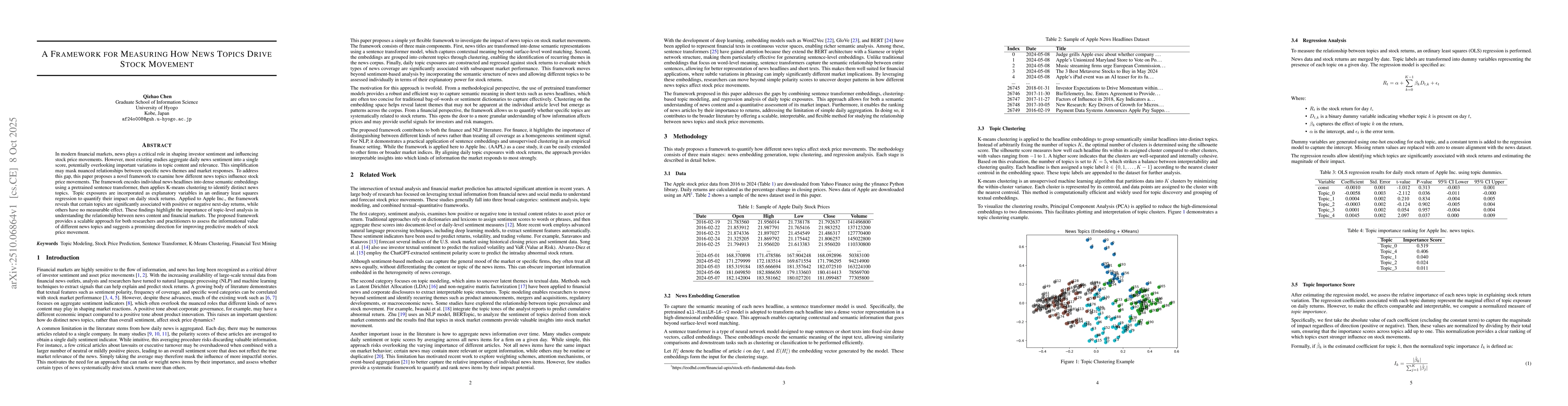

In modern financial markets, news plays a critical role in shaping investor sentiment and influencing stock price movements. However, most existing studies aggregate daily news sentiment into a single score, potentially overlooking important variations in topic content and relevance. This simplification may mask nuanced relationships between specific news themes and market responses. To address this gap, this paper proposes a novel framework to examine how different news topics influence stock price movements. The framework encodes individual news headlines into dense semantic embeddings using a pretrained sentence transformer, then applies K-means clustering to identify distinct news topics. Topic exposures are incorporated as explanatory variables in an ordinary least squares regression to quantify their impact on daily stock returns. Applied to Apple Inc., the framework reveals that certain topics are significantly associated with positive or negative next-day returns, while others have no measurable effect. These findings highlight the importance of topic-level analysis in understanding the relationship between news content and financial markets. The proposed framework provides a scalable approach for both researchers and practitioners to assess the informational value of different news topics and suggests a promising direction for improving predictive models of stock price movement.

AI Key Findings

Generated Oct 10, 2025

Methodology

The study combines sentence transformer embeddings, K-means clustering for topic modeling, and ordinary least squares regression to analyze the impact of news topics on stock returns. News headlines are converted into dense vectors, clustered into topics, and then used as explanatory variables in regression analysis.

Key Results

- Topic_0 and Topic_4 showed statistically significant associations with stock returns, with Topic_0 linked to negative returns and Topic_4 to positive returns.

- The framework revealed that not all news topics equally influence stock returns, highlighting the importance of topic-level analysis over aggregated sentiment measures.

- Topic importance scores indicated that Topic_0 and Topic_4 had the strongest impact on stock movements, with other topics showing negligible effects.

Significance

This research provides a scalable framework for understanding how specific news topics influence financial markets, offering insights for investors and practitioners to better interpret news content's impact on stock prices.

Technical Contribution

The paper introduces a novel framework integrating semantic embeddings, clustering-based topic modeling, and regression analysis to quantify the impact of news topics on stock price movements.

Novelty

This work differentiates itself by focusing on topic-level analysis rather than aggregated sentiment scores, utilizing sentence transformers for semantic understanding and providing a scalable approach for financial market analysis.

Limitations

- The interpretation of topics from K-means clustering is subjective and lacks explicit semantic clarity compared to methods like LDA or BERTopic.

- The model's overall significance was marginal, suggesting other factors may influence stock returns beyond the analyzed topics.

Future Work

- Exploring dynamic topic modeling or probabilistic topic assignment to capture evolving market narratives.

- Incorporating additional textual features like sentiment scores or news source credibility to enhance explanatory power.

- Applying more advanced regression or machine learning models to capture nonlinear relationships between news topics and stock returns.

- Extending the framework across multiple companies and markets to test its robustness and generalizability.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCausalStock: Deep End-to-end Causal Discovery for News-driven Stock Movement Prediction

Rui Yan, Xin Gao, Shuo Shang et al.

Improved Stock Price Movement Classification Using News Articles Based on Embeddings and Label Smoothing

Shaeke Salman, Xiuwen Liu, Luis Villamil et al.

Comments (0)