Summary

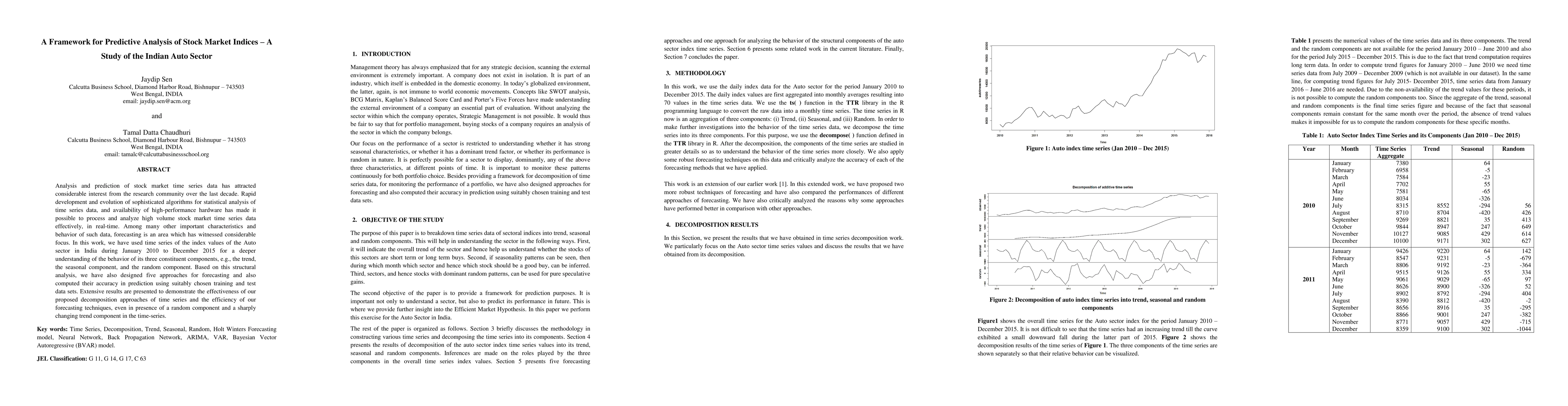

Analysis and prediction of stock market time series data has attracted considerable interest from the research community over the last decade. Rapid development and evolution of sophisticated algorithms for statistical analysis of time series data, and availability of high-performance hardware has made it possible to process and analyze high volume stock market time series data effectively, in real-time. Among many other important characteristics and behavior of such data, forecasting is an area which has witnessed considerable focus. In this work, we have used time series of the index values of the Auto sector in India during January 2010 to December 2015 for a deeper understanding of the behavior of its three constituent components, e.g., the trend, the seasonal component, and the random component. Based on this structural analysis, we have also designed five approaches for forecasting and also computed their accuracy in prediction using suitably chosen training and test data sets. Extensive results are presented to demonstrate the effectiveness of our proposed decomposition approaches of time series and the efficiency of our forecasting techniques, even in presence of a random component and a sharply changing trend component in the time-series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparative Study of Portfolio Optimization Methods for the Indian Stock Market

Jaydip Sen, Arup Dasgupta, Partha Pratim Sengupta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)