Summary

We present a network-based framework for simulating systemic risk that considers shock propagation in banking systems. In particular, the framework allows the modeller to reflect a top-down framework where a shock to one bank in the system affects the solvency and liquidity position of other banks, through systemic market risks and consequential liquidity strains. We illustrate the framework with an application using South African bank balance sheet data. Spikes in simulated assessments of systemic risk agree closely with spikes in documented subjective assessments of this risk. This indicates that network models can be useful for monitoring systemic risk levels. The model results are sensitive to liquidity risk and market sentiment and therefore the related parameters are important considerations when using a network approach to systemic risk modelling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

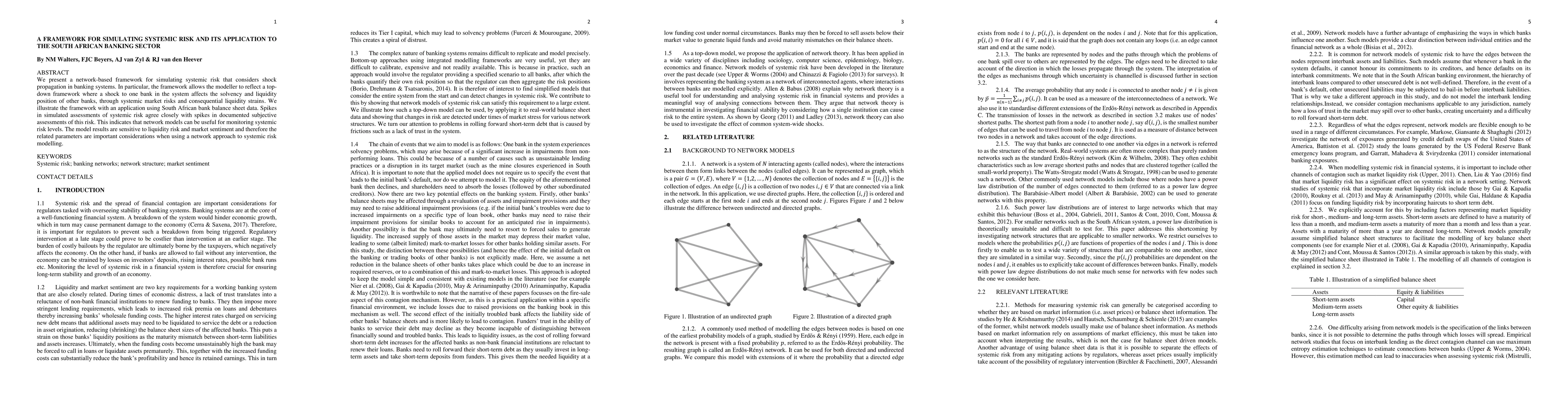

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDerivatives Holdings and Systemic Risk in the U.S. Banking Sector

Sergio Mayordomo, Juan Ignacio Peña, Maria Rodriguez-Moreno

| Title | Authors | Year | Actions |

|---|

Comments (0)