Summary

We propose a method based on continuous time Markov chain approximation to compute the distribution of Parisian stopping times and price Parisian options under general one-dimensional Markov processes. We prove the convergence of the method under a general setting and obtain sharp estimate of the convergence rate for diffusion models. Our theoretical analysis reveals how to design the grid of the CTMC to achieve faster convergence. Numerical experiments are conducted to demonstrate the accuracy and efficiency of our method for both diffusion and jump models. To show the versality of our approach, we develop extensions for multi-sided Parisian stopping times, the joint distribution of Parisian stopping times and first passage times, Parisian bonds and for more sophisticated models like regime-switching and stochastic volatility models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

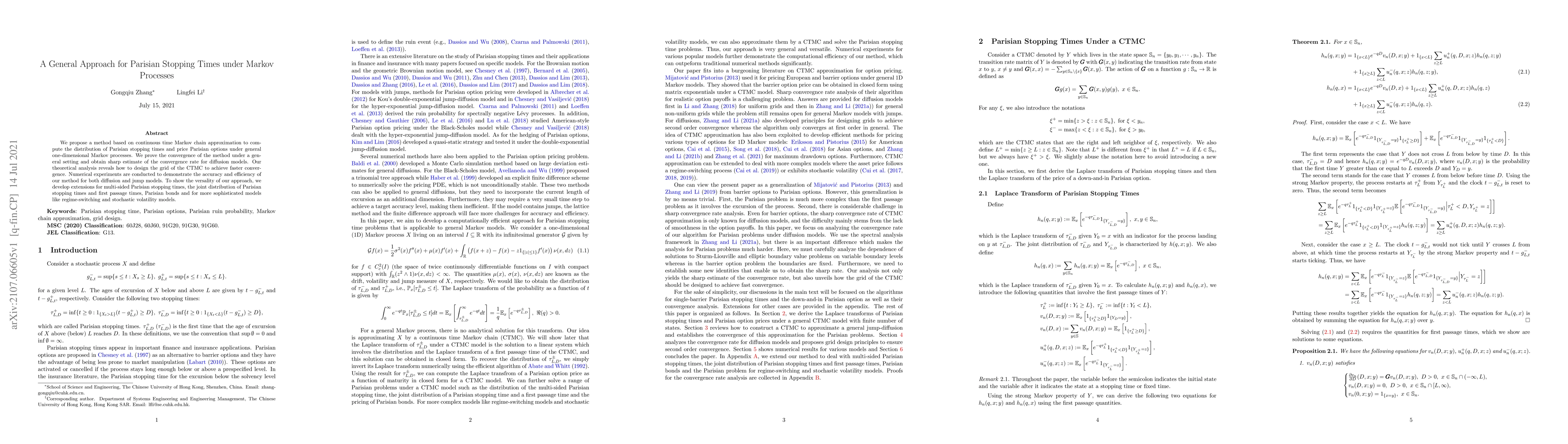

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing American Parisian Options under General Time-Inhomogeneous Markov Models

Yuhao Liu, Gongqiu Zhang, Nian Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)