Summary

The endowment effect, coined by Nobel Laureate Richard Thaler, posits that people tend to inflate the value of items they own. This bias was studied, both theoretically and empirically, with respect to a single item. Babaioff et al. [EC'18] took a first step at extending this study beyond a single item. They proposed a specific formulation of the endowment effect in combinatorial settings, and showed that equilibrium existence with respect to the endowed valuations extends from gross substitutes to submodular valuations, but provably fails to extend to XOS valuations. Extending the endowment effect to combinatorial settings can take different forms. In this work, we devise a framework that captures a space of endowment effects, upon which we impose a partial order, which preserves endowment equilibrium existence. Within this framework, we provide existence and welfare guarantees for endowment equilibria corresponding to various endowment effects. Our main results are the following: (1) For markets with XOS valuations, we introduce an endowment effect that is stronger than that of Babaioff et al., for which an endowment equilibrium is guaranteed to exist and gives at least half of the optimal welfare. Moreover, this equilibrium can be reached via a variant of the flexible ascent auction. (2) For markets with arbitrary valuations, we show that bundling leads to a sweeping positive result. In particular, if items can be prepacked into indivisible bundles, there always exists an endowment equilibrium with optimal welfare. Moreover, we provide a polynomial algorithm that given an arbitrary allocation $S$, computes an endowment equilibrium with the same welfare guarantee as in $S$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

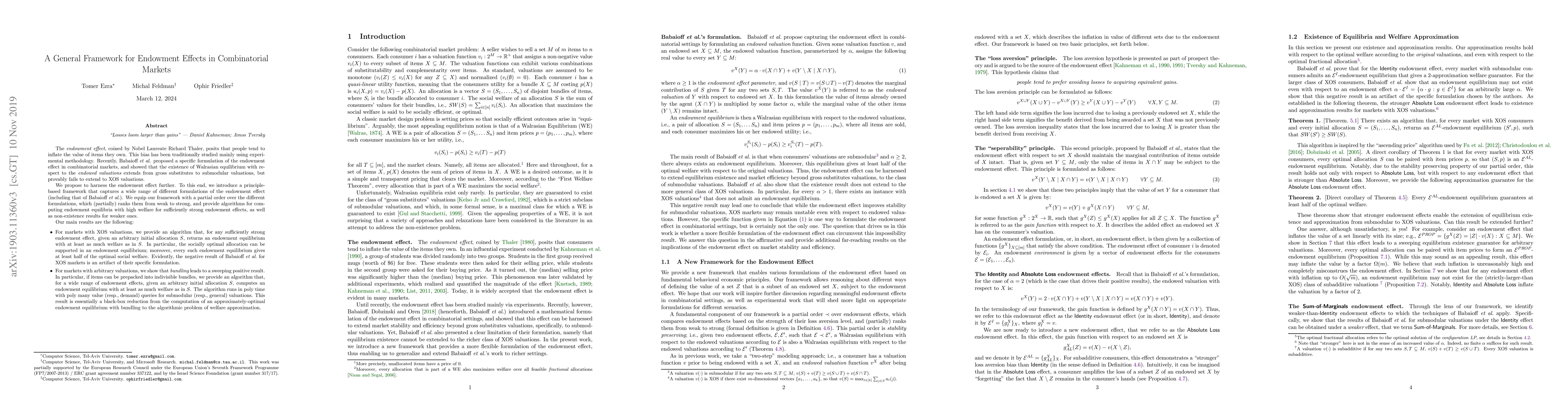

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)