Authors

Summary

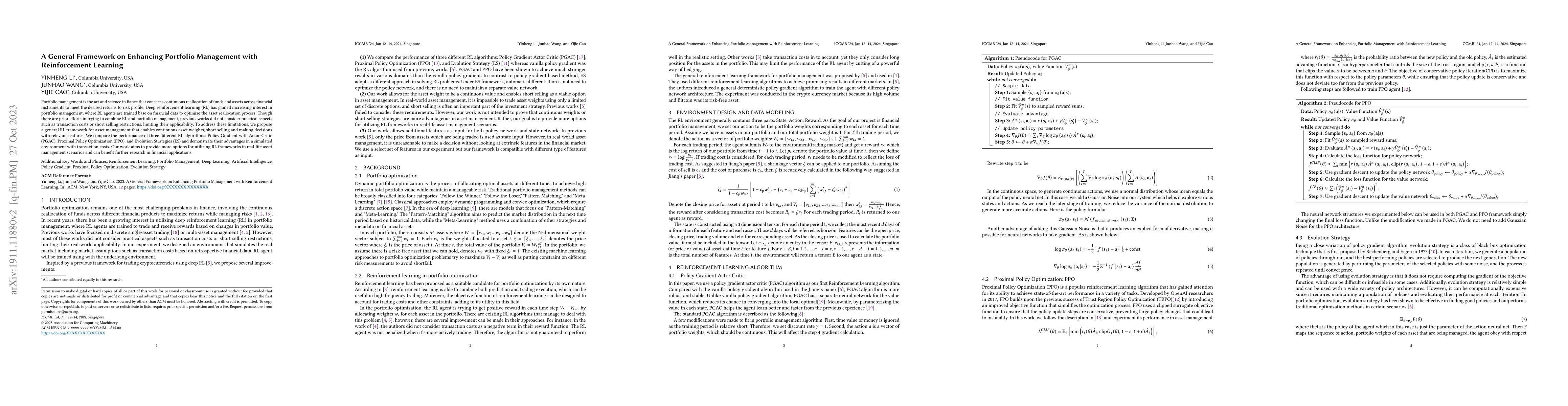

Portfolio management is the art and science in fiance that concerns continuous reallocation of funds and assets across financial instruments to meet the desired returns to risk profile. Deep reinforcement learning (RL) has gained increasing interest in portfolio management, where RL agents are trained base on financial data to optimize the asset reallocation process. Though there are prior efforts in trying to combine RL and portfolio management, previous works did not consider practical aspects such as transaction costs or short selling restrictions, limiting their applicability. To address these limitations, we propose a general RL framework for asset management that enables continuous asset weights, short selling and making decisions with relevant features. We compare the performance of three different RL algorithms: Policy Gradient with Actor-Critic (PGAC), Proximal Policy Optimization (PPO), and Evolution Strategies (ES) and demonstrate their advantages in a simulated environment with transaction costs. Our work aims to provide more options for utilizing RL frameworks in real-life asset management scenarios and can benefit further research in financial applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMTS: A Deep Reinforcement Learning Portfolio Management Framework with Time-Awareness and Short-Selling

Ángel F. García-Fernández, Angelos Stefanidis, Jionglong Su et al.

A Novel Experts Advice Aggregation Framework Using Deep Reinforcement Learning for Portfolio Management

Jafar Habibi, Hamed Taherkhani, MohammadAmin Fazli et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)