Summary

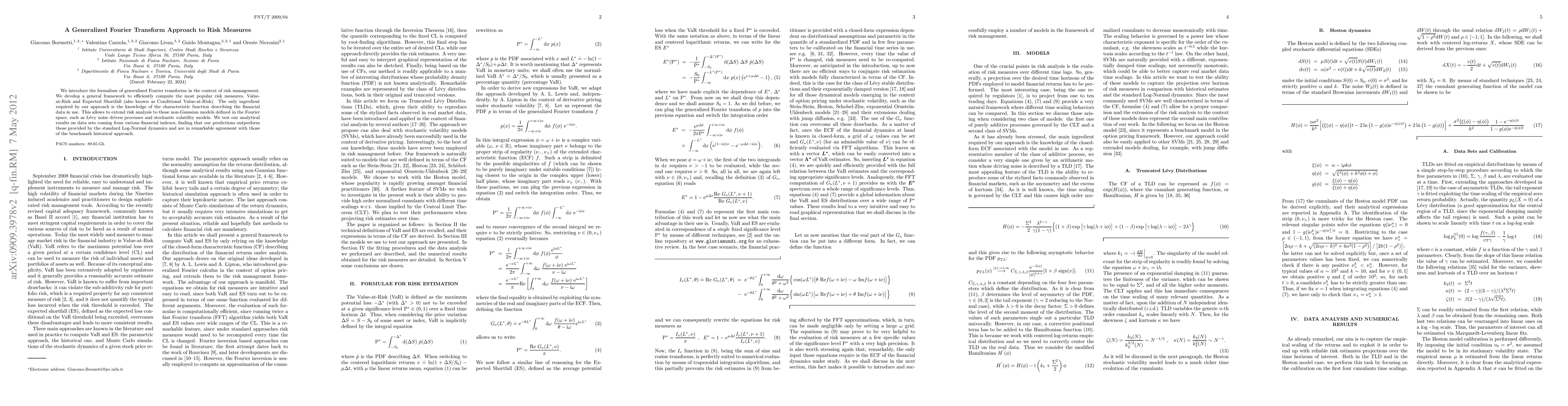

We introduce the formalism of generalized Fourier transforms in the context of risk management. We develop a general framework to efficiently compute the most popular risk measures, Value-at-Risk and Expected Shortfall (also known as Conditional Value-at-Risk). The only ingredient required by our approach is the knowledge of the characteristic function describing the financial data in use. This allows to extend risk analysis to those non-Gaussian models defined in the Fourier space, such as Levy noise driven processes and stochastic volatility models. We test our analytical results on data sets coming from various financial indexes, finding that our predictions outperform those provided by the standard Log-Normal dynamics and are in remarkable agreement with those of the benchmark historical approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA noncommutative approach to the graphon Fourier transform

Mahya Ghandehari, Jeannette Janssen, Nauzer Kalyaniwalla

| Title | Authors | Year | Actions |

|---|

Comments (0)