Authors

Summary

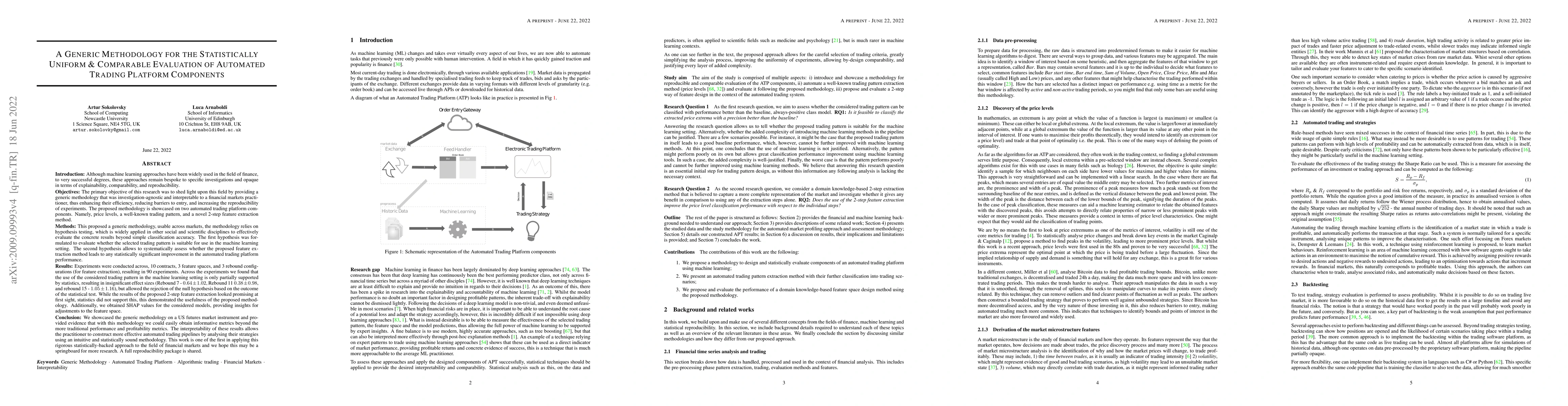

Although machine learning approaches have been widely used in the field of finance, to very successful degrees, these approaches remain bespoke to specific investigations and opaque in terms of explainability, comparability, and reproducibility. The primary objective of this research was to shed light upon this field by providing a generic methodology that was investigation-agnostic and interpretable to a financial markets practitioner, thus enhancing their efficiency, reducing barriers to entry, and increasing the reproducibility of experiments. The proposed methodology is showcased on two automated trading platform components. Namely, price levels, a well-known trading pattern, and a novel 2-step feature extraction method. The methodology relies on hypothesis testing, which is widely applied in other social and scientific disciplines to effectively evaluate the concrete results beyond simple classification accuracy. The main hypothesis was formulated to evaluate whether the selected trading pattern is suitable for use in the machine learning setting. Across the experiments we found that the use of the considered trading pattern in the machine learning setting is only partially supported by statistics, resulting in insignificant effect sizes (Rebound 7 - $0.64 \pm 1.02$, Rebound 11 $0.38 \pm 0.98$, and rebound 15 - $1.05 \pm 1.16$), but allowed the rejection of the null hypothesis. We showcased the generic methodology on a US futures market instrument and provided evidence that with this methodology we could easily obtain informative metrics beyond the more traditional performance and profitability metrics. This work is one of the first in applying this rigorous statistically-backed approach to the field of financial markets and we hope this may be a springboard for more research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Generic and Automated Methodology to Simulate Melting Point

Shipeng Zhu, Fu-Zhi Dai, Si-Hao Yuan et al.

Conceptualizing A Multi-Sided Platform For Cloud Computing Resource Trading

Max Schemmer, Niklas Kühl, Carsten Holtmann et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)