Summary

The purpose of this paper is to introduce a new growth adjusted price-earnings measure (GA-P/E) and assess its efficacy as measure of value and predictor of future stock returns. Taking inspiration from the interpretation of the traditional price-earnings ratio as a period of time, the new measure computes the requisite payback period whilst accounting for earnings growth. Having derived the measure, we outline a number of its properties before conducting an extensive empirical study utilising a sorted portfolio methodology. We find that the returns of the low GA-P/E stocks exceed those of the high GA-P/E stocks, both in an absolute sense and also on a risk-adjusted basis. Furthermore, the returns from the low GA-P/E porfolio was found to exceed those of the value portfolio arising from a P/E sort on the same pool of stocks. Finally, the returns of our GA-P/E sorted porfolios were subjected to analysis by conducting regressions against the standard Fama and French risk factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

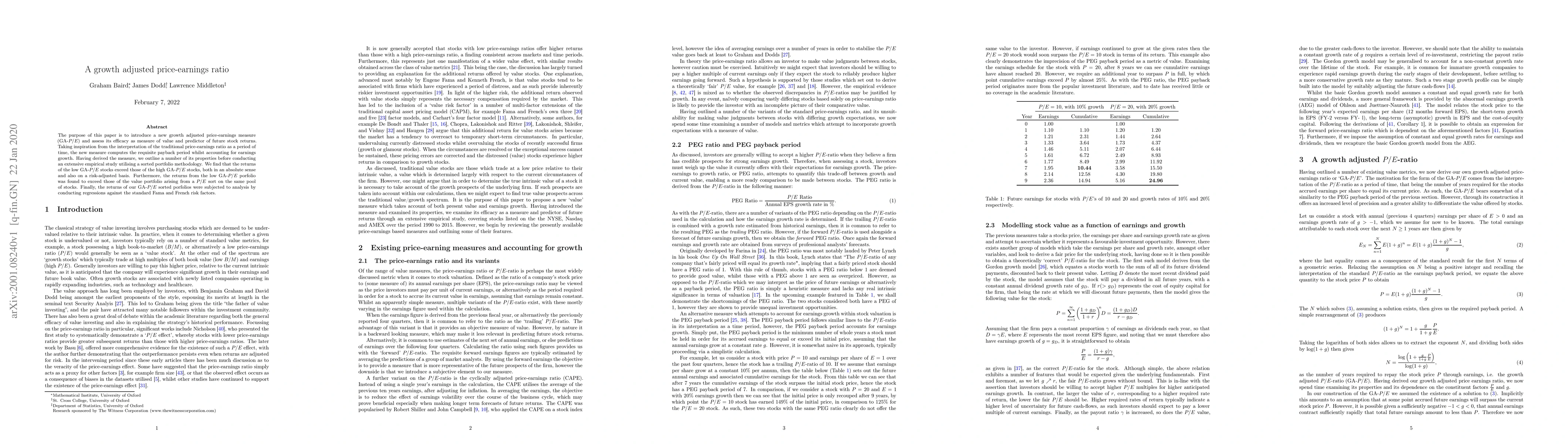

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

Non-Existent Moments of Earnings Growth

Yuya Sasaki, Yulong Wang, Silvia Sarpietro

| Title | Authors | Year | Actions |

|---|

Comments (0)