Summary

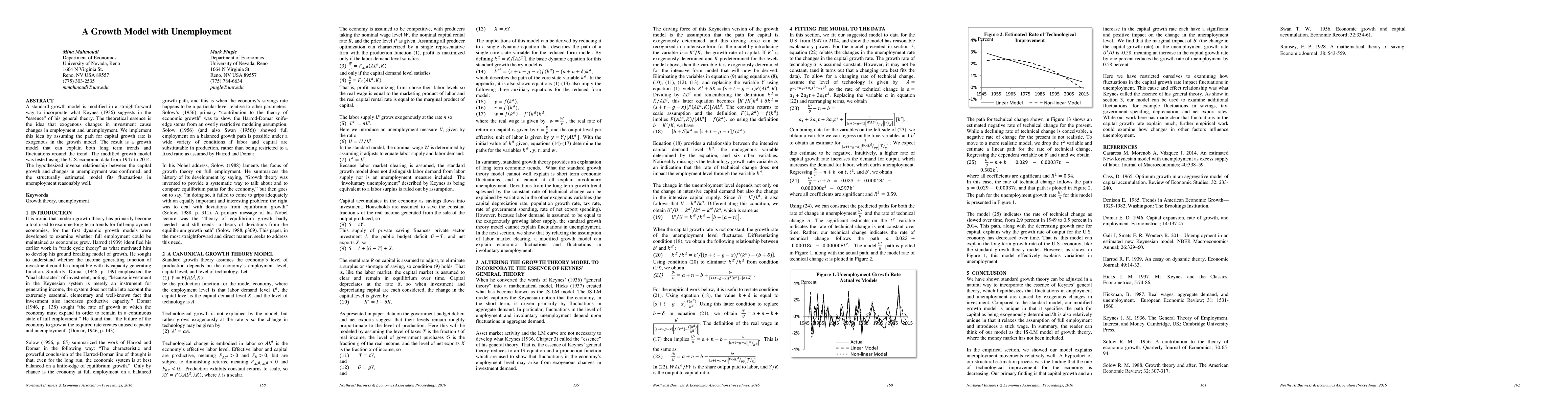

A standard growth model is modified in a straightforward way to incorporate what Keynes (1936) suggests in the "essence" of his general theory. The theoretical essence is the idea that exogenous changes in investment cause changes in employment and unemployment. We implement this idea by assuming the path for capital growth rate is exogenous in the growth model. The result is a growth model that can explain both long term trends and fluctuations around the trend. The modified growth model was tested using the U.S. economic data from 1947 to 2014. The hypothesized inverse relationship between the capital growth and changes in unemployment was confirmed, and the structurally estimated model fits fluctuations in unemployment reasonably well.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research uses a modified growth model that incorporates the essence of Keynes' general theory, assuming exogenous changes in investment cause fluctuations in employment and unemployment.

Key Results

- The model explains variations in unemployment relatively well.

- Capital growth has a significant positive impact on the change in unemployment level.

- An increase in capital growth rate reduces the growth rate of unemployment by 0.58 percent.

Significance

This research is important because it provides a new perspective on the relationship between capital growth and unemployment, which can inform policy decisions.

Technical Contribution

The research introduces a new dynamic equation that describes the path of employment and unemployment in response to exogenous changes in investment.

Novelty

This work is novel because it relaxes the assumption of full employment and introduces a stick wage, which are not commonly used in standard growth models.

Limitations

- The model assumes exogenous changes in investment, which may not accurately reflect real-world dynamics.

- The results are based on US economic data from 1947 to 2014, which may not be generalizable to other countries or time periods.

Future Work

- Examining how changes in other factors influence unemployment.

- Developing a more comprehensive model that incorporates additional variables and assumptions.

- Testing the model on different datasets and time periods to increase its robustness and applicability.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)