Authors

Summary

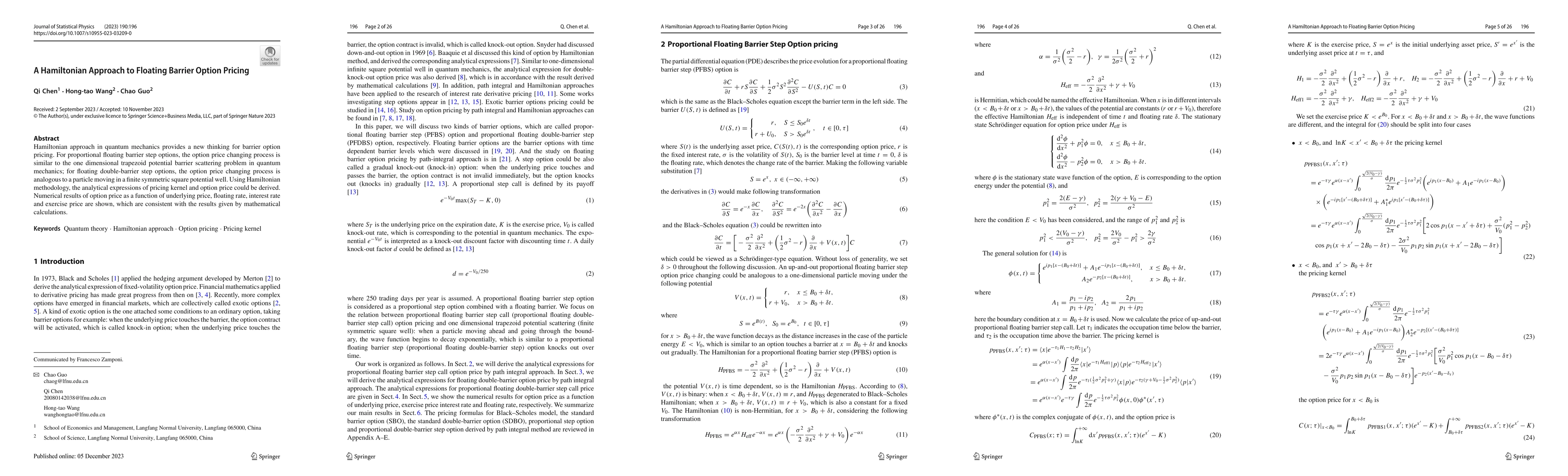

Hamiltonian approach in quantum mechanics provides a new thinking for barrier option pricing. For proportional floating barrier step options, the option price changing process is similar to the one dimensional trapezoid potential barrier scattering problem in quantum mechanics; for floating double-barrier step options, the option price changing process is analogous to a particle moving in a finite symmetric square potential well. Using Hamiltonian methodology, the analytical expressions of pricing kernel and option price could be derived. Numerical results of option price as a function of underlying price, floating rate, interest rate and exercise price are shown, which are consistent with the results given by mathematical calculations.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper applies a Hamiltonian approach, drawing analogies from quantum mechanics, to price floating barrier options. It derives analytical expressions for the pricing kernel and option price using the Hamiltonian methodology for both proportional floating barrier step options and double-barrier step options.

Key Results

- Analytical expressions for the pricing kernel and option price are derived for proportional floating barrier step and double-barrier step options.

- Numerical results for option prices as functions of underlying price, floating rate, interest rate, and exercise price are presented and validated against mathematical calculations.

Significance

This research provides a novel method for pricing complex financial derivatives, leveraging concepts from quantum mechanics, which could lead to more accurate and efficient pricing models in financial markets.

Technical Contribution

The paper introduces a Hamiltonian framework for pricing floating barrier options, providing a new perspective by linking option price changes to a particle's motion under various potentials in quantum mechanics.

Novelty

The novelty of this work lies in its application of quantum mechanics principles to financial option pricing, offering a fresh perspective and potentially more accurate pricing models compared to traditional methods.

Limitations

- The paper focuses on proportional floating barriers and does not explore other types of barriers.

- The methodology assumes a one-dimensional model and may not fully capture the complexities of multi-dimensional financial markets.

Future Work

- Investigate the application of this Hamiltonian approach to other types of barrier options and financial instruments.

- Extend the model to higher dimensions to better reflect real-world financial market dynamics.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Hamiltonian Approach to Barrier Option Pricing Under Vasicek Model

Chao Guo, Qi Chen Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)