Authors

Summary

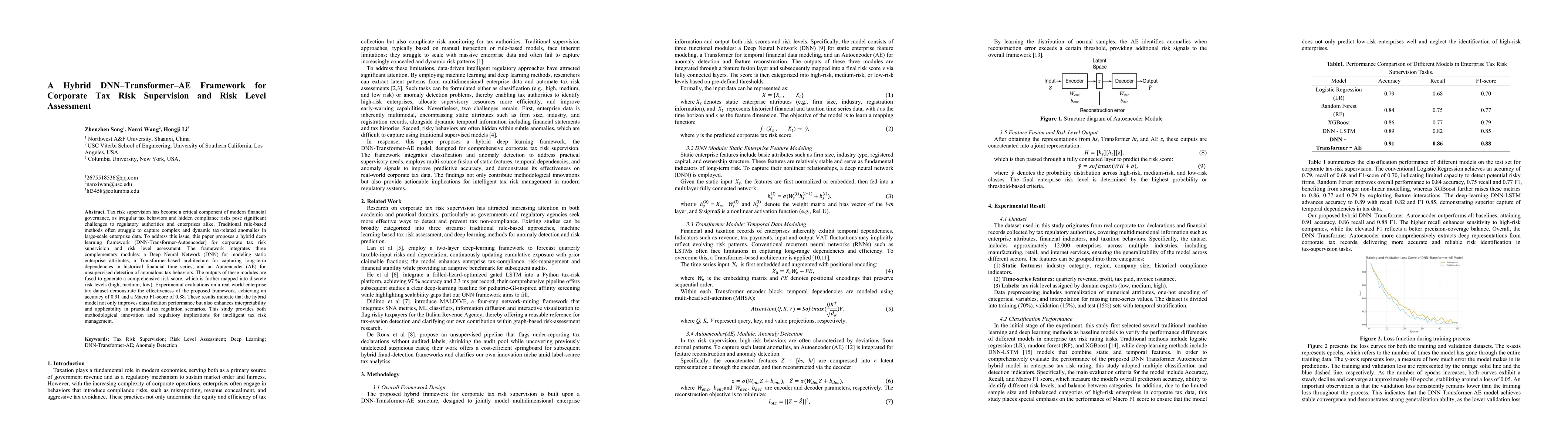

Tax risk supervision has become a critical component of modern financial governance, as irregular tax behaviors and hidden compliance risks pose significant challenges to regulatory authorities and enterprises alike. Traditional rule-based methods often struggle to capture complex and dynamic tax-related anomalies in large-scale enterprise data. To address this issue, this paper proposes a hybrid deep learning framework (DNN-Transformer-Autoencoder) for corporate tax risk supervision and risk level assessment. The framework integrates three complementary modules: a Deep Neural Network (DNN) for modeling static enterprise attributes, a Transformer-based architecture for capturing long-term dependencies in historical financial time series, and an Autoencoder (AE) for unsupervised detection of anomalous tax behaviors. The outputs of these modules are fused to generate a comprehensive risk score, which is further mapped into discrete risk levels (high, medium, low). Experimental evaluations on a real-world enterprise tax dataset demonstrate the effectiveness of the proposed framework, achieving an accuracy of 0.91 and a Macro F1-score of 0.88. These results indicate that the hybrid model not only improves classification performance but also enhances interpretability and applicability in practical tax regulation scenarios. This study provides both methodological innovation and regulatory implications for intelligent tax risk management.

AI Key Findings

Generated Oct 01, 2025

Methodology

The paper proposes a hybrid deep learning framework combining DNN, Transformer, and Autoencoder modules to model static enterprise attributes, temporal financial data, and detect anomalies for tax risk assessment.

Key Results

- The hybrid model achieved 0.91 accuracy and 0.88 macro F1-score in tax risk classification, outperforming traditional methods and single-architecture deep learners.

- The framework effectively integrates static features, temporal dependencies, and anomaly signals to enhance predictive accuracy and risk detection.

- The model demonstrates strong generalization ability with stable validation loss, indicating robustness in capturing meaningful patterns beyond training data.

Significance

This research provides a methodological innovation for intelligent tax risk management, offering regulators a reliable tool for grading enterprise risk and enabling precision supervision and resource allocation.

Technical Contribution

The paper introduces a DNN-Transformer-AE hybrid framework that combines static attribute modeling, temporal dependency analysis, and unsupervised anomaly detection for comprehensive tax risk assessment.

Novelty

The hybrid framework uniquely integrates DNN, Transformer, and Autoencoder modules to address both classification and anomaly detection in tax risk supervision, improving interpretability and applicability in real-world regulatory scenarios.

Limitations

- The input features are primarily confined to financial and operational indicators, excluding macroeconomic conditions and inter-firm relationships.

- The model's computational complexity may pose challenges for deployment in resource-constrained tax offices.

Future Work

- Integrate macroeconomic and policy data into the feature space to enhance model comprehensiveness.

- Develop interpretable and lightweight models (e.g., attention-based visualizations or model compression) for practical deployment.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTRACE: Transformer-based Risk Assessment for Clinical Evaluation

Konstantinos Karantzalos, Dionysis Christopoulos, Sotiris Spanos et al.

Comments (0)