Summary

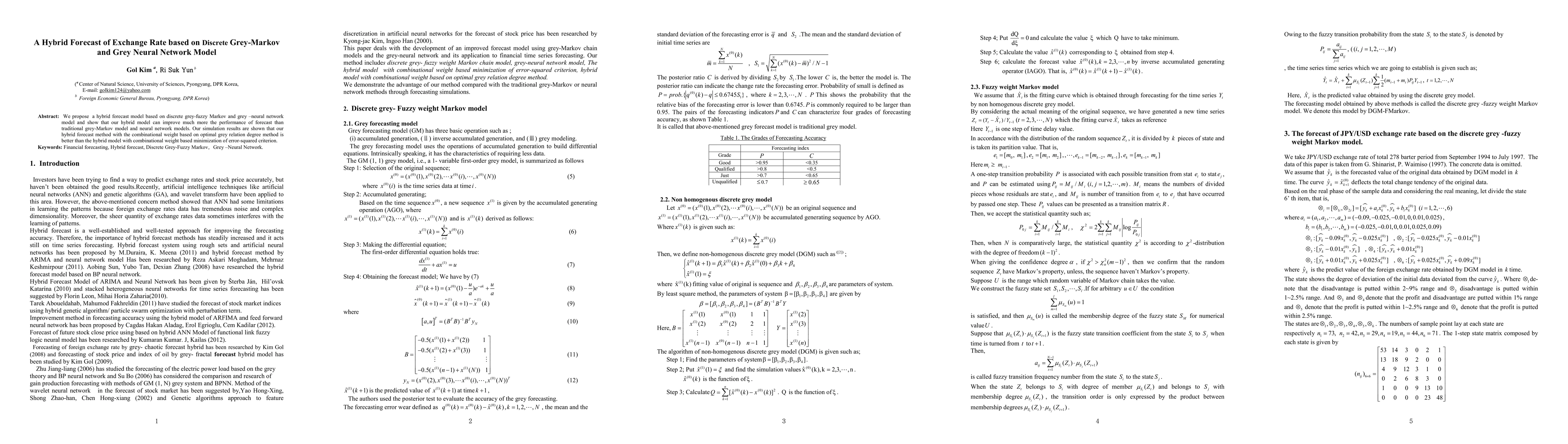

We propose a hybrid forecast model based on discrete grey-fuzzy Markov and grey neural network model and show that our hybrid model can improve much more the performance of forecast than traditional grey-Markov model and neural network models. Our simulation results are shown that our hybrid forecast method with the combinational weight based on optimal grey relation degree method is better than the hybrid model with combinational weight based minimization of error-squared criterion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)