Authors

Summary

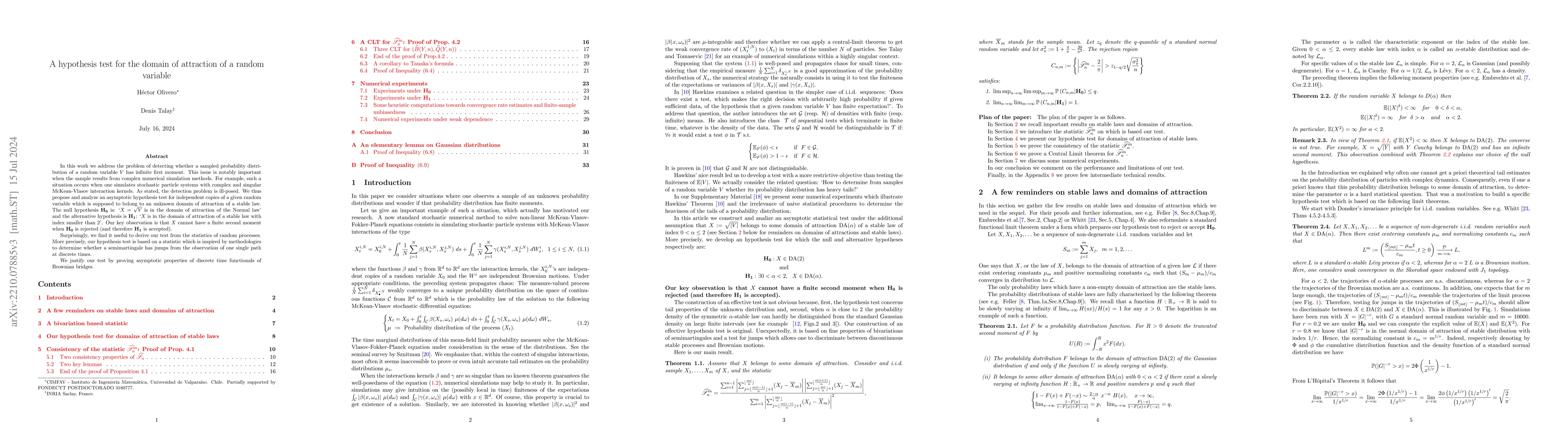

In this work we address the problem of detecting wether a sampled probability distribution has infinite expectation. This issue is notably important when the sample results from complex numerical simulation methods. For example, such a situation occurs when one simulates stochastic particle systems with complex and singular McKean-Vlasov interaction kernels. As stated, the detection problem is ill-posed. We thus propose and analyze an asymptotic hypothesis test for independent copies of a given random variable~$X$ which is supposed to belong to an unknown domain of attraction of a stable law. The null hypothesis $\mathbf{H_0}$ is: `$X$ is in the domain of attraction of the Normal law' and the alternative hypothesis is $\mathbf{H_1}$: `$X$ is in the domain of attraction of a stable law with index smaller than 2'. Our key observation is that~$X$ cannot have a finite second moment when $\mathbf{H_0}$ is rejected (and therefore $\mathbf{H_1}$ is accepted). Surprisingly, we find it useful to derive our test from the statistics of random processes. More precisely, our hypothesis test is based on a statistic which is inspired by statistical methodologies to determine whether a semimartingale has jumps from the observation of one single path at discrete times. We justify our test by proving asymptotic properties of discrete time functionals of Brownian bridges.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)