Authors

Summary

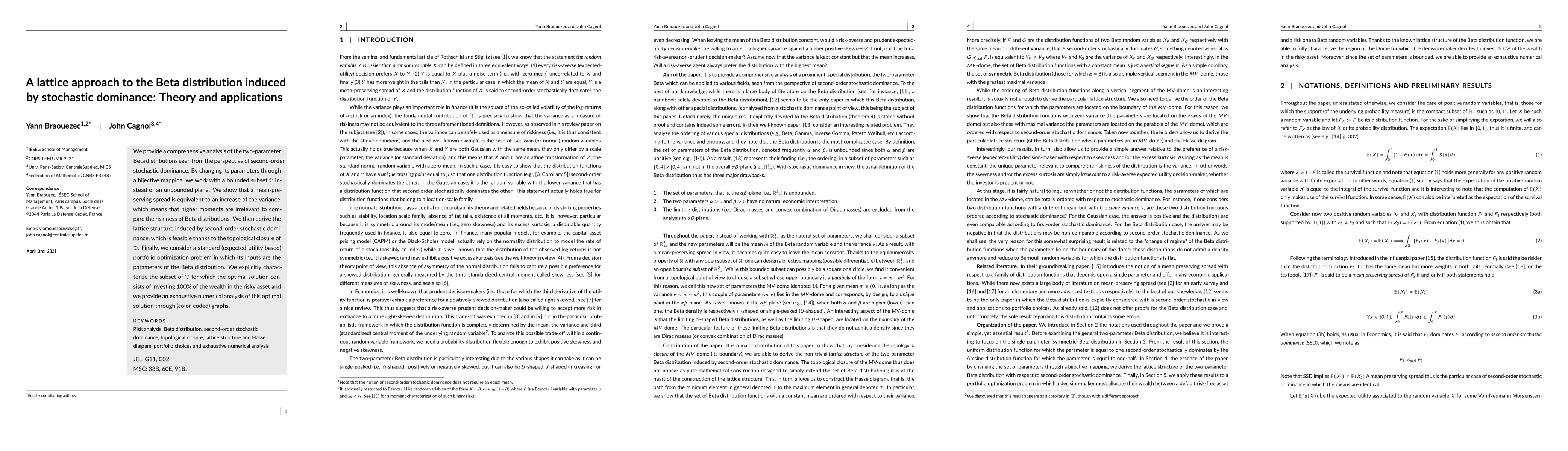

We provide a comprehensive analysis of the two-parameter Beta distributions seen from the perspective of second-order stochastic dominance. By changing its parameters through a bijective mapping, we work with a bounded subset D instead of an unbounded plane. We show that a mean-preserving spread is equivalent to an increase of the variance, which means that higher moments are irrelevant to compare the riskiness of Beta distributions. We then derive the lattice structure induced by second-order stochastic dominance, which is feasible thanks to the topological closure of D. Finally, we consider a standard (expected-utility based) portfolio optimization problem in which its inputs are the parameters of the Beta distribution. We explicitly characterize the subset of D for which the optimal solution consists of investing 100% of the wealth in the risky asset and we provide an exhaustive numerical analysis of this optimal solution through (color-coded) graphs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatistical Decision Theory Respecting Stochastic Dominance

Charles F. Manski, Aleksey Tetenov

Multivariate Stochastic Dominance via Optimal Transport and Applications to Models Benchmarking

Kristjan Greenewald, Youssef Mroueh, Mattia Rigotti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)