Authors

Summary

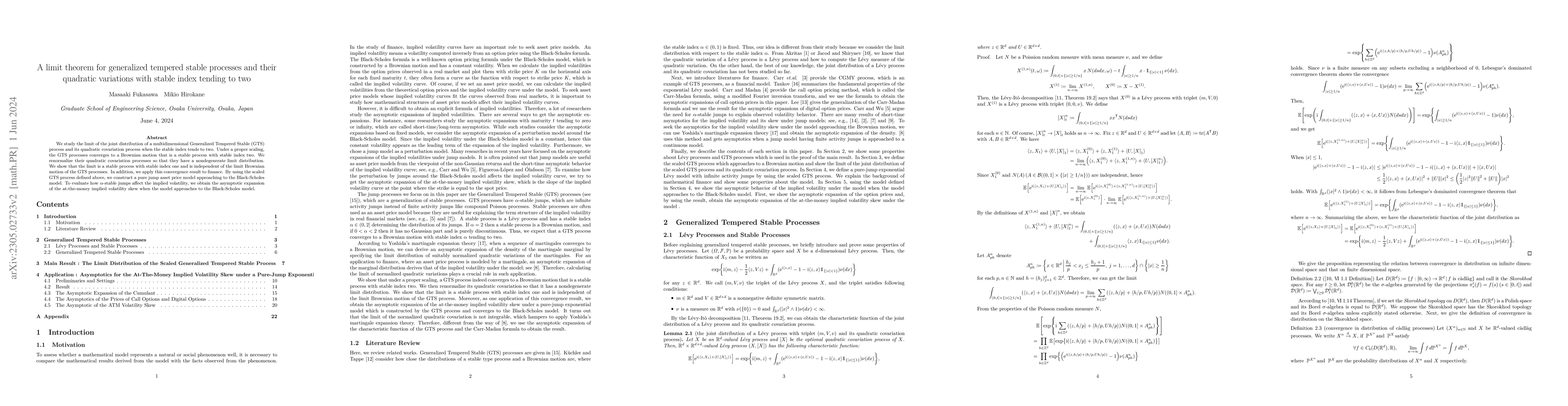

We study the limit of the joint distribution of a multidimensional Generalized Tempered Stable (GTS) process and its quadratic covariation process when the stable index tends to two. Under a proper scaling, the GTS processes converges to a Brownian motion that is a stable process with stable index two. We renormalize their quadratic covariation processes so that they have a nondegenerate limit distribution. We show that the limit is a stable process with stable index one and is independent of the limit Brownian motion of the GTS processes. In addition, we apply this convergence result to finance. By using the scaled GTS process defined above, we construct a pure jump asset price model approaching to the Black-Scholes model. To evaluate how $\alpha$-stable jumps affect the implied volatility, we obtain the asymptotic expansion of the at-the-money implied volatility skew when the model approaches to the Black-Scholes model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)