Summary

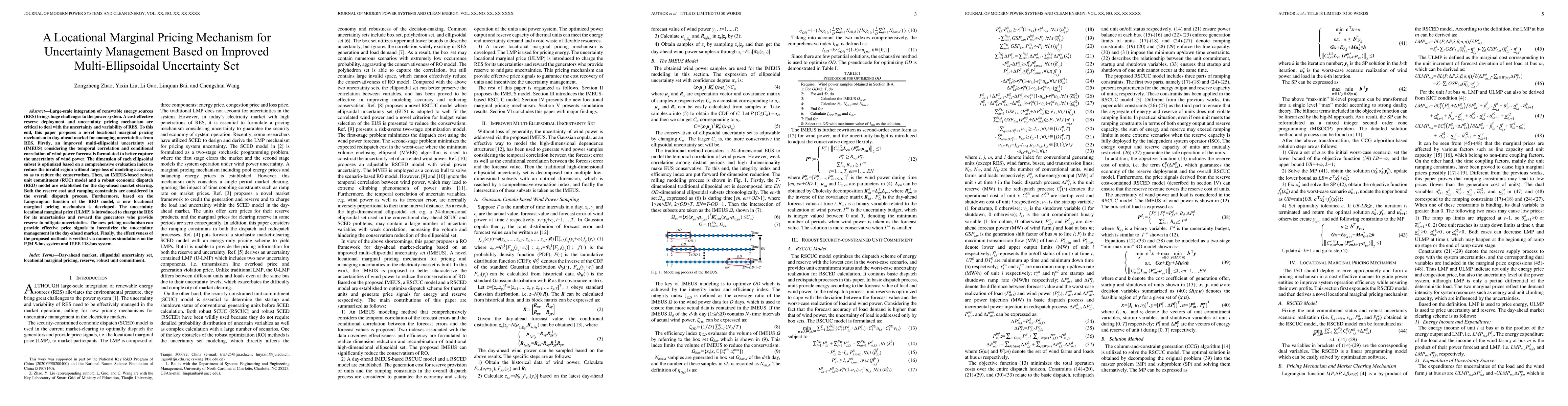

Large-scale integration of renewable energy sources (RES) brings huge challenges to the power system. A cost-effective reserve deployment and uncertainty pricing mechanism are critical to deal with the uncertainty and variability of RES. To this end, this paper proposes a novel locational marginal pricing mechanism in day-ahead market for managing uncertainties from RES. Firstly, an improved multi-ellipsoidal uncertainty set (IMEUS) considering the temporal correlation and conditional correlation of wind power forecast is formulated to better capture the uncertainty of wind power. The dimension of each ellipsoidal subset is optimized based on a comprehensive evaluation index to reduce the invalid region without large loss of modeling accuracy, so as to reduce the conservatism. Then, an IMEUS-based robust unit commitment (RUC) model and a robust economic dispatch (RED) model are established for the day-ahead market clearing. Both the reserve cost and ramping constraints are considered in the overall dispatch process. Furthermore, based on the Langrangian function of the RED model, a new locational marginal pricing mechanism is developed. The uncertainty locational marginal price (ULMP) is introduced to charge the RES for its uncertainties and reward the generators who provide reserve to mitigate uncertainties. The new pricing mechanism can provide effective price signals to incentivize the uncertainty management in the day-ahead market. Finally, the effectiveness of the proposed methods is verified via numerous simulations on the PJM 5-bus system and IEEE 118-bus system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)