Summary

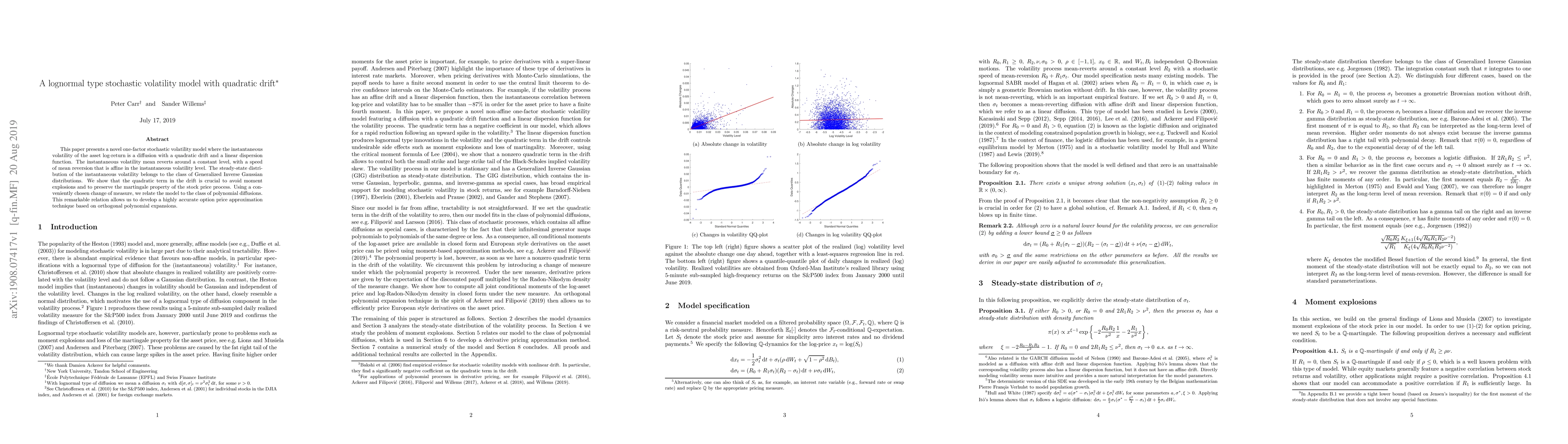

This paper presents a novel one-factor stochastic volatility model where the instantaneous volatility of the asset log-return is a diffusion with a quadratic drift and a linear dispersion function. The instantaneous volatility mean reverts around a constant level, with a speed of mean reversion that is affine in the instantaneous volatility level. The steady-state distribution of the instantaneous volatility belongs to the class of Generalized Inverse Gaussian distributions. We show that the quadratic term in the drift is crucial to avoid moment explosions and to preserve the martingale property of the stock price process. Using a conveniently chosen change of measure, we relate the model to the class of polynomial diffusions. This remarkable relation allows us to develop a highly accurate option price approximation technique based on orthogonal polynomial expansions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCalibrating Local Volatility Models with Stochastic Drift and Diffusion

Orcan Ogetbil, Bernhard Hientzsch, Narayan Ganesan

A lower bound for the volatility swap in the lognormal SABR model

E. Alòs, F. Rolloos, K. Shiraya

| Title | Authors | Year | Actions |

|---|

Comments (0)