Summary

Cryptocurrencies' values often respond aggressively to major policy changes, but none of the existing indices informs on the market risks associated with regulatory changes. In this paper, we quantify the risks originating from new regulations on FinTech and cryptocurrencies (CCs), and analyse their impact on market dynamics. Specifically, a Cryptocurrency Regulatory Risk IndeX (CRRIX) is constructed based on policy-related news coverage frequency. The unlabeled news data are collected from the top online CC news platforms and further classified using a Latent Dirichlet Allocation model and Hellinger distance. Our results show that the machine-learning-based CRRIX successfully captures major policy-changing moments. The movements for both the VCRIX, a market volatility index, and the CRRIX are synchronous, meaning that the CRRIX could be helpful for all participants in the cryptocurrency market. The algorithms and Python code are available for research purposes on www.quantlet.de.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

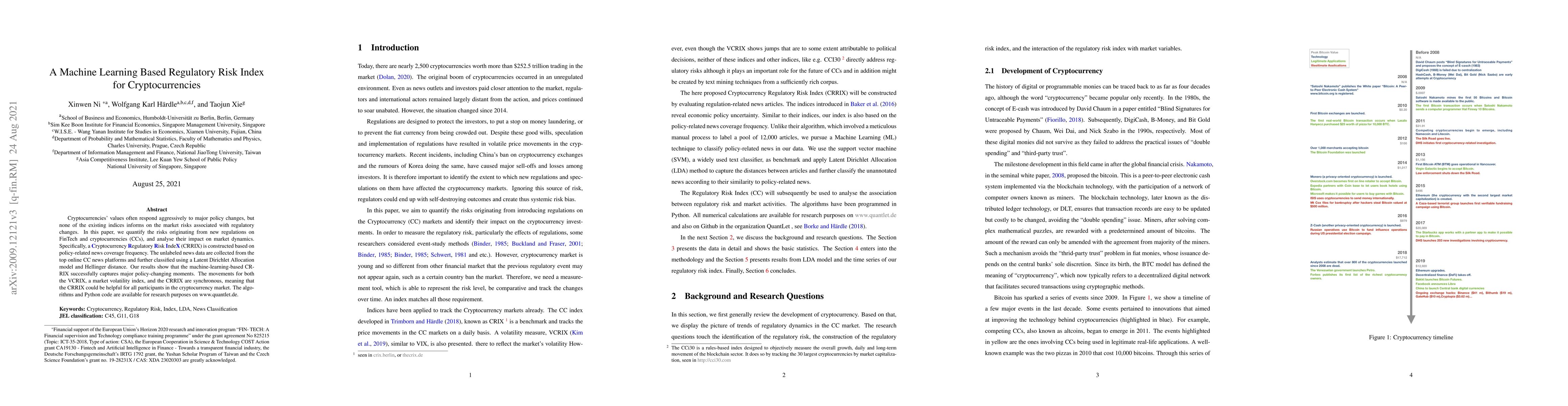

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Methods for Gene Regulatory Network Inference

Jianlin Cheng, Akshata Hegde, Tom Nguyen

| Title | Authors | Year | Actions |

|---|

Comments (0)