Authors

Summary

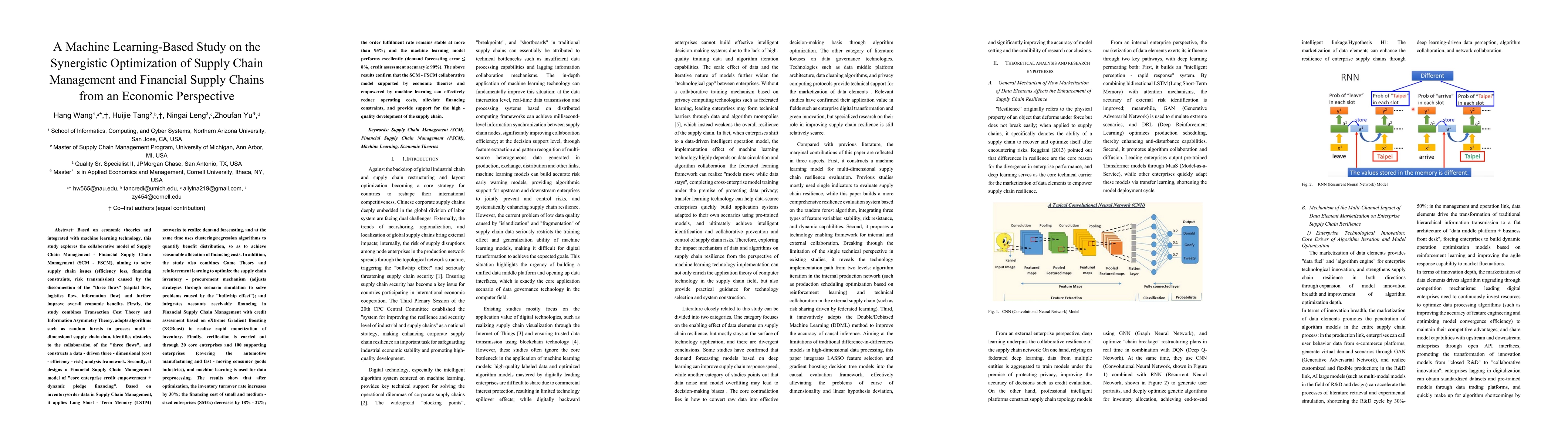

Based on economic theories and integrated with machine learning technology, this study explores a collaborative Supply Chain Management and Financial Supply Chain Management (SCM - FSCM) model to solve issues like efficiency loss, financing constraints, and risk transmission. We combine Transaction Cost and Information Asymmetry theories and use algorithms such as random forests to process multi-dimensional data and build a data-driven, three-dimensional (cost-efficiency-risk) analysis framework. We then apply an FSCM model of "core enterprise credit empowerment plus dynamic pledge financing." We use Long Short-Term Memory (LSTM) networks for demand forecasting and clustering/regression algorithms for benefit allocation. The study also combines Game Theory and reinforcement learning to optimize the inventory-procurement mechanism and uses eXtreme Gradient Boosting (XGBoost) for credit assessment to enable rapid monetization of inventory. Verified with 20 core and 100 supporting enterprises, the results show a 30\% increase in inventory turnover, an 18\%-22\% decrease in SME financing costs, a stable order fulfillment rate above 95\%, and excellent model performance (demand forecasting error <= 8\%, credit assessment accuracy >= 90\%). This SCM-FSCM model effectively reduces operating costs, alleviates financing constraints, and supports high-quality supply chain development.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnhancing supply chain security with automated machine learning

Haibo Wang, Bahram Alidaee, Lutfu S. Sua

Financial Twin Chain, a Platform to Support Financial Sustainability in Supply Chains

Giuseppe Galante, Christiancarmine Esposito, Pietro Catalano et al.

What if? Causal Machine Learning in Supply Chain Risk Management

Alexandra Brintrup, Mateusz Wyrembek, George Baryannis

Comments (0)