Summary

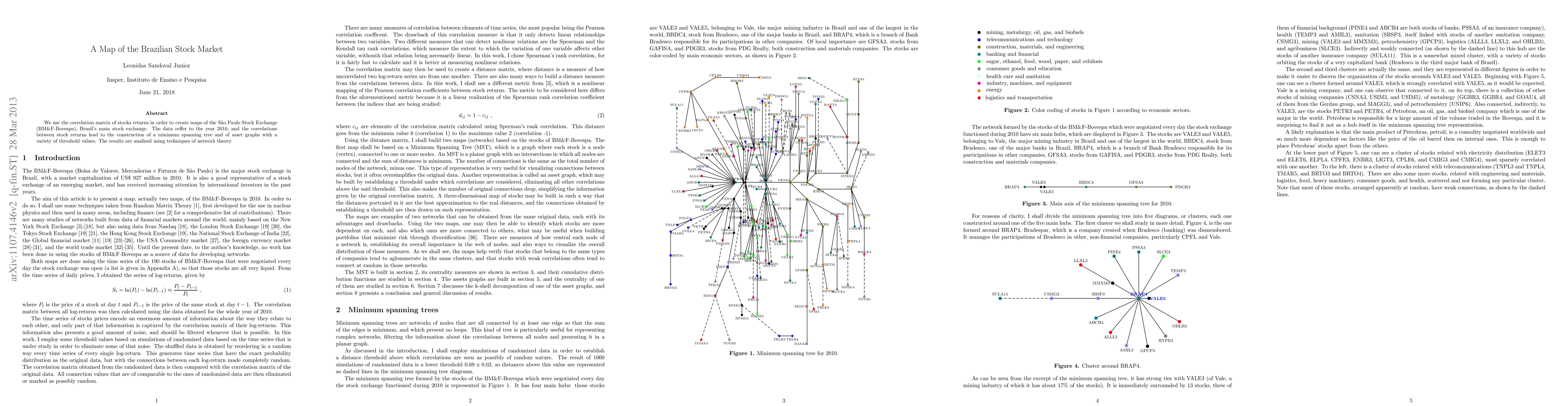

We use the correlation matrix of stocks returns in order to create maps of the S\~ao Paulo Stock Exchange (BM&F-Bovespa), Brazil's main stock exchange. The data reffer to the year 2010, and the correlations between stock returns lead to the construction of a minimum spanning tree and of asset graphs with a variety of threshold values. The results are analised using techniques of network theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)