Summary

We consider a Nash equilibrium between two high-frequency traders in a simple market impact model with transient price impact and additional quadratic transaction costs. Extending a result by Sch\"oneborn (2008), we prove existence and uniqueness of the Nash equilibrium and show that for small transaction costs the high-frequency traders engage in a "hot-potato game", in which the same asset position is sold back and forth. We then identify a critical value for the size of the transaction costs above which all oscillations disappear and strategies become buy-only or sell-only. Numerical simulations show that for both traders the expected costs can be lower with transaction costs than without. Moreover, the costs can increase with the trading frequency when there are no transaction costs, but decrease with the trading frequency when transaction costs are sufficiently high. We argue that these effects occur due to the need of protection against predatory trading in the regime of low transaction costs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

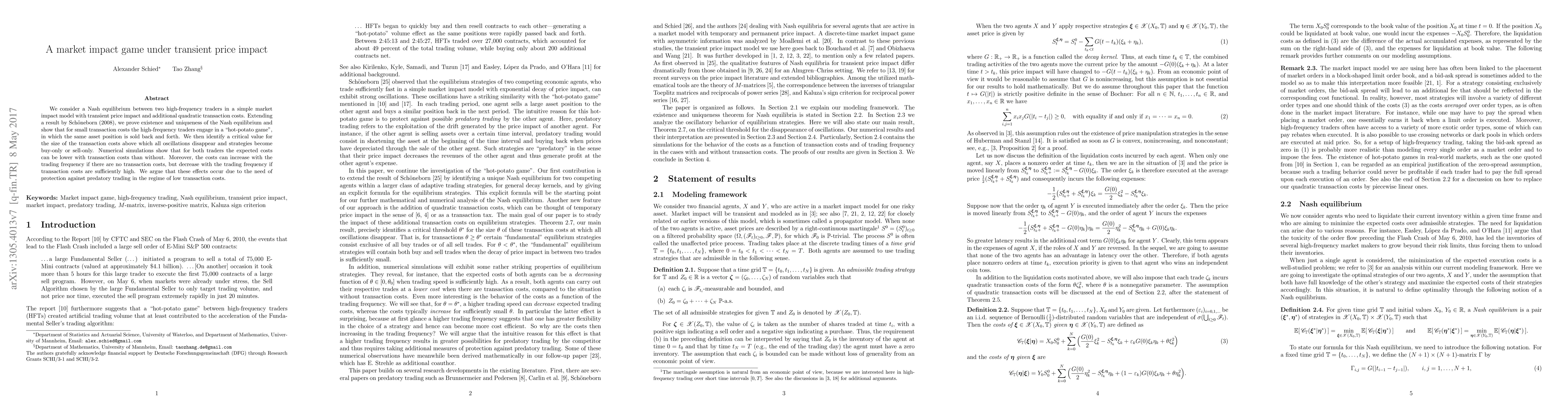

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)