Summary

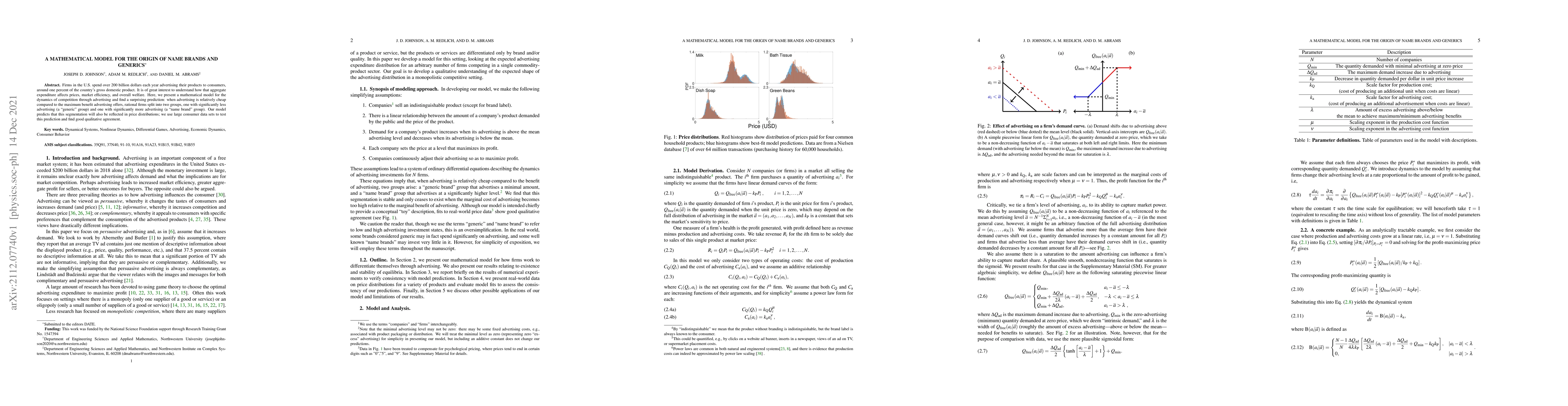

Firms in the U.S. spend over 200 billion dollars each year advertising their products to consumers, around one percent of the country's gross domestic product. It is of great interest to understand how that aggregate expenditure affects prices, market efficiency, and overall welfare. Here, we present a mathematical model for the dynamics of competition through advertising and find a surprising prediction: when advertising is relatively cheap compared to the maximum benefit advertising offers, rational firms split into two groups, one with significantly less advertising (a "generic" group) and one with significantly more advertising (a "name brand" group). Our model predicts that this segmentation will also be reflected in price distributions; we use large consumer data sets to test this prediction and find good qualitative agreement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)