Summary

This paper presents a bootstrapped p-value white noise test based on the maximum correlation, for a time series that may be weakly dependent under the null hypothesis. The time series may be prefiltered residuals. The test statistic is a normalized weighted maximum sample correlation, where the maximum lag increases at a rate slower than the sample size. We only require uncorrelatedness under the null hypothesis, along with a moment contraction dependence property that includes mixing and non-mixing sequences. We show Shao's (2011) dependent wild bootstrap is valid for a much larger class of processes than originally considered. It is also valid for residuals from a general class of parametric models as long as the bootstrap is applied to a first order expansion of the sample correlation. We prove the bootstrap validity without exploiting extreme value theory (standard in the literature) or recent Gaussian approximation theory. Finally, we extend Escanciano and Lobato's (2009) automatic maximum lag selection to our setting with an unbounded choice set, and find it works strikingly well in controlled experiments. Our proposed test achieves accurate size under various white noise null hypotheses and high power under various alternative hypotheses including distant serial dependence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

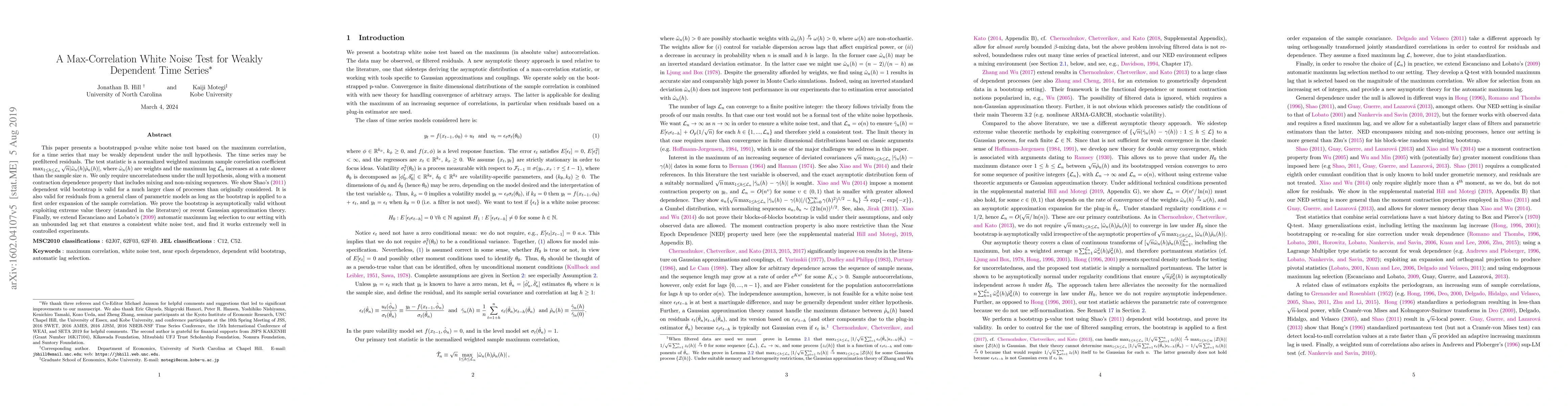

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)