Summary

We establish the existence and uniqueness of the equilibrium for a stochastic mean-field game of optimal investment. The analysis covers both finite and infinite time horizons, and the mean-field interaction of the representative company with a mass of identical and indistinguishable firms is modeled through the time-dependent price at which the produced good is sold. At equilibrium, this price is given in terms of a nonlinear function of the expected (optimally controlled) production capacity of the representative company at each time. The proof of the existence and uniqueness of the mean-field equilibrium relies on a priori estimates and the study of nonlinear integral equations, but employs different techniques for the finite and infinite horizon cases. Additionally, we investigate the deterministic counterpart of the mean-field game under study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

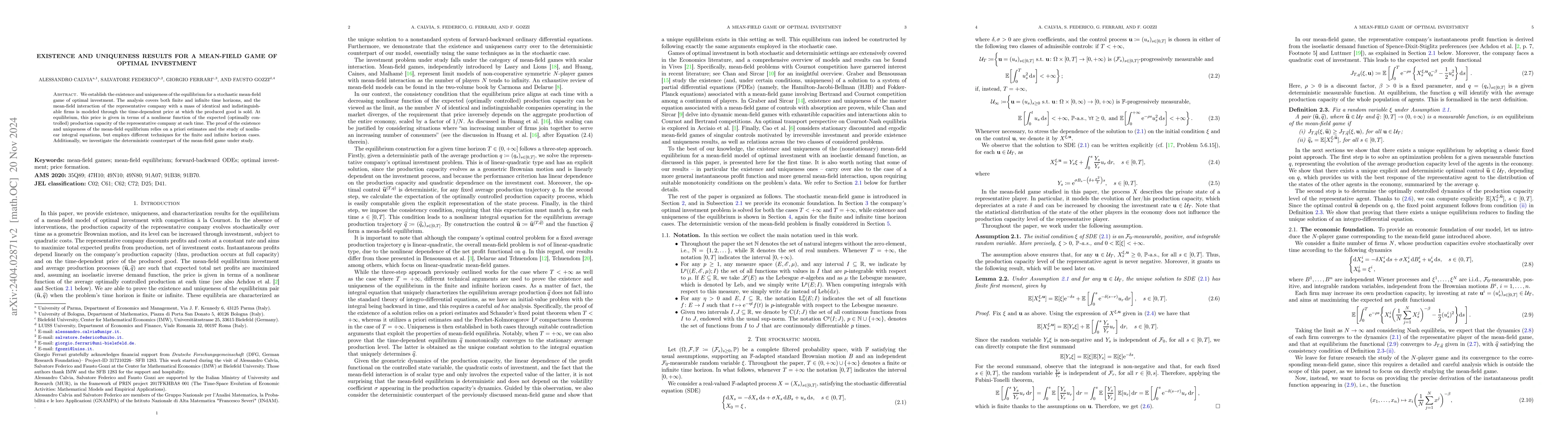

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Stationary Mean-Field Equilibrium Model of Irreversible Investment in a Two-Regime Economy

Giorgio Ferrari, Matteo Basei, René Aid

Mean Field Game of Optimal Relative Investment with Jump Risk

Xiang Yu, Lijun Bo, Shihua Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)