Authors

Summary

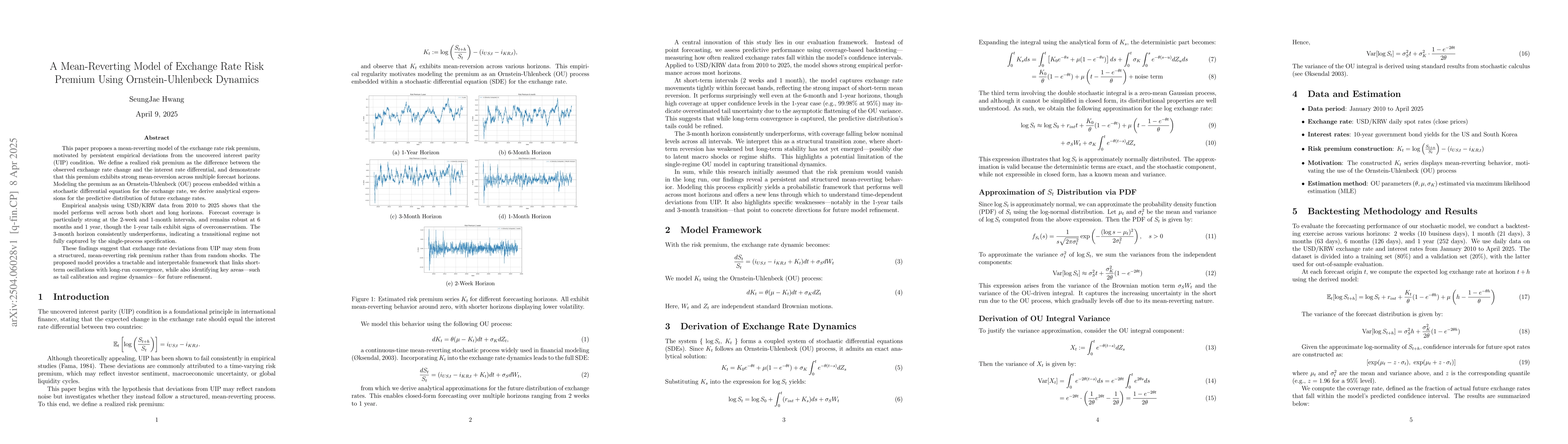

This paper examines the empirical failure of uncovered interest parity (UIP) and proposes a structural explanation based on a mean-reverting risk premium. We define a realized premium as the deviation between observed exchange rate returns and the interest rate differential, and demonstrate its strong mean-reverting behavior across multiple horizons. Motivated by this pattern, we model the risk premium using an Ornstein-Uhlenbeck (OU) process embedded within a stochastic differential equation for the exchange rate. Our model yields closed-form approximations for future exchange rate distributions, which we evaluate using coverage-based backtesting. Applied to USD/KRW data from 2010 to 2025, the model shows strong predictive performance at both short-term and long-term horizons, while underperforming at intermediate (3-month) horizons and showing conservative behavior in the tails of long-term forecasts. These results suggest that exchange rate deviations from UIP may reflect structured, forecastable dynamics rather than pure noise, and point to future modeling improvements via regime-switching or time-varying volatility.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs a mean-reverting model of exchange rate risk premium using Ornstein-Uhlenbeck (OU) dynamics, evaluating predictive performance via coverage-based backtesting. It models the risk premium with an OU process embedded in a stochastic differential equation for the exchange rate, providing closed-form approximations for future exchange rate distributions.

Key Results

- The model shows strong predictive performance at short-term (2 weeks, 1 month) and long-term horizons (6 months, 1 year) for USD/KRW data from 2010 to 2025.

- The model underperforms at the intermediate (3-month) horizon, indicating a structural transition zone where short-term reversion has weakened but long-term stability has not yet emerged.

- The model captures time-dependent deviations from uncovered interest parity (UIP) and offers a probabilistic framework for understanding exchange rate dynamics.

Significance

This research is important as it provides a structural explanation for the empirical failure of uncovered interest parity (UIP), suggesting that exchange rate deviations from UIP may reflect structured, forecastable dynamics rather than pure noise.

Technical Contribution

The paper presents a mean-reverting model of exchange rate risk premium using Ornstein-Uhlenbeck dynamics, providing closed-form approximations for future exchange rate distributions and a novel evaluation framework based on coverage-based backtesting.

Novelty

This work differs from existing research by explicitly modeling the risk premium process as an Ornstein-Uhlenbeck process, offering a structured approach to understanding time-dependent exchange rate deviations from uncovered interest parity.

Limitations

- The model shows conservative behavior in the tails of long-term forecasts, indicating potential overestimation of long-term uncertainty.

- The single-regime OU model struggles to capture transitional dynamics, particularly at the 3-month horizon.

Future Work

- Future modeling improvements could involve regime-switching or time-varying volatility to better capture transitional phases like the 3-month horizon.

- Incorporating dynamic volatility structures, macroeconomic covariates, or time-varying parameters may enhance the model's ability to characterize transition behaviors and long-term tail risks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon trivial optimal sampling rate for estimating a Lipschitz-continuous function in presence of mean-reverting Ornstein-Uhlenbeck noise

Enrico Bernardi, Alberto Lanconelli, Christopher S. A. Lauria et al.

No citations found for this paper.

Comments (0)