Summary

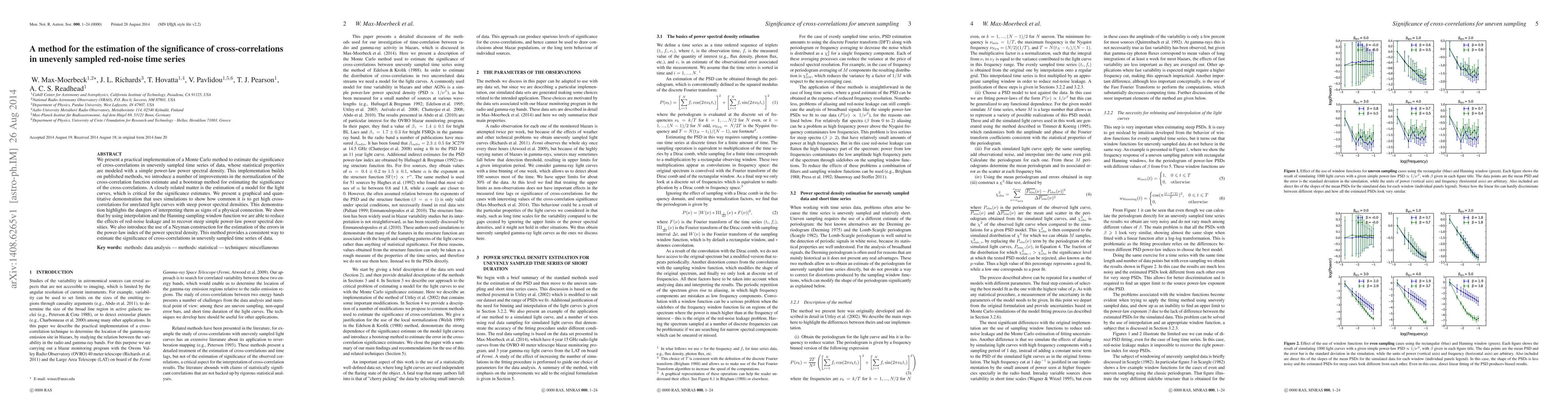

We present a practical implementation of a Monte Carlo method to estimate the significance of cross-correlations in unevenly sampled time series of data, whose statistical properties are modeled with a simple power-law power spectral density. This implementation builds on published methods, we introduce a number of improvements in the normalization of the cross-correlation function estimate and a bootstrap method for estimating the significance of the cross-correlations. A closely related matter is the estimation of a model for the light curves, which is critical for the significance estimates. We present a graphical and quantitative demonstration that uses simulations to show how common it is to get high cross-correlations for unrelated light curves with steep power spectral densities. This demonstration highlights the dangers of interpreting them as signs of a physical connection. We show that by using interpolation and the Hanning sampling window function we are able to reduce the effects of red-noise leakage and to recover steep simple power-law power spectral densities. We also introduce the use of a Neyman construction for the estimation of the errors in the power-law index of the power spectral density. This method provides a consistent way to estimate the significance of cross-correlations in unevenly sampled time series of data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigh-pass Filter Periodogram: An Improved Power Spectral Density Estimator for Unevenly Sampled Data

Nicola Marchili, Ezequiel Albentosa-Ruiz

Mind the gaps: improved methods for the detection of periodicities in unevenly-sampled data

A. Gúrpide, M. Middleton

| Title | Authors | Year | Actions |

|---|

Comments (0)