Summary

A new mixture autoregressive model based on Student's $t$-distribution is proposed. A key feature of our model is that the conditional $t$-distributions of the component models are based on autoregressions that have multivariate $t$-distributions as their (low-dimensional) stationary distributions. That autoregressions with such stationary distributions exist is not immediate. Our formulation implies that the conditional mean of each component model is a linear function of past observations and the conditional variance is also time varying. Compared to previous mixture autoregressive models our model may therefore be useful in applications where the data exhibits rather strong conditional heteroskedasticity. Our formulation also has the theoretical advantage that conditions for stationarity and ergodicity are always met and these properties are much more straightforward to establish than is common in nonlinear autoregressive models. An empirical example employing a realized kernel series based on S&P 500 high-frequency data shows that the proposed model performs well in volatility forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

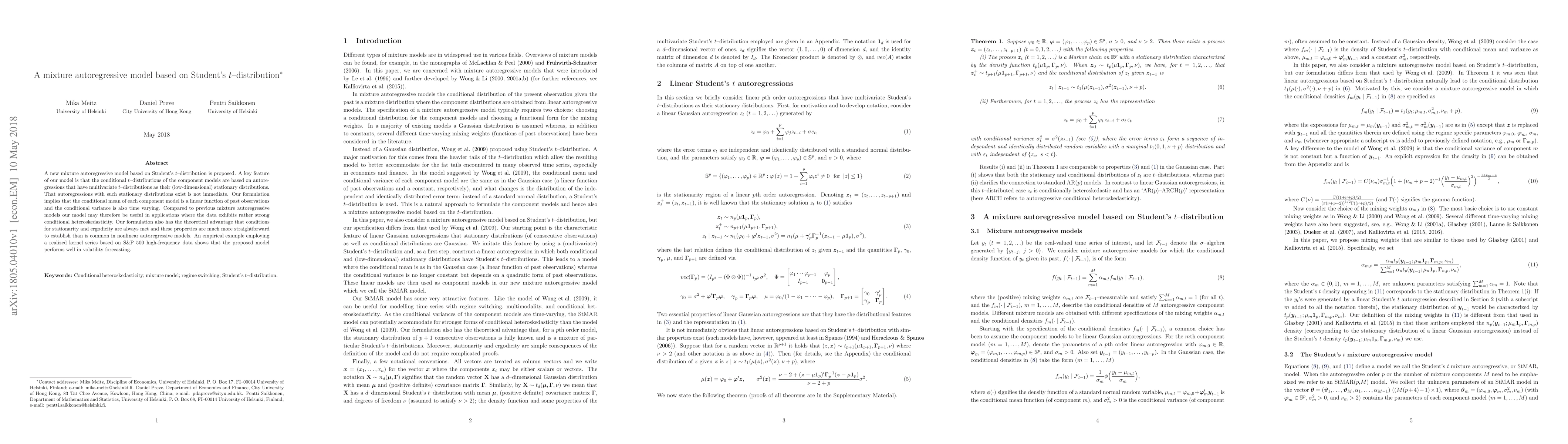

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)