Summary

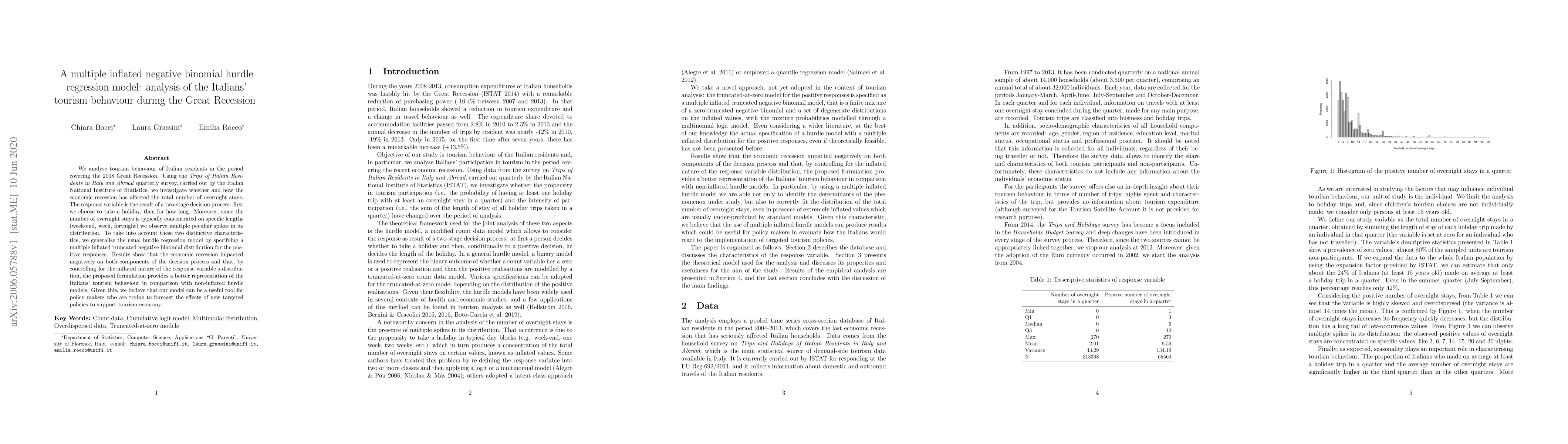

We analyse tourism behaviour of Italian residents in the period covering the 2008 Great Recession. Using the Trips of Italian Residents in Italy and Abroad quarterly survey, carried out by the Italian National Institute of Statistics, we investigate whether and how the economic recession has affected the total number of overnight stays. The response variable is the result of a two-stage decision process: first we choose to take a holiday, then for how long. Moreover, since the number of overnight stays is typically concentrated on specific lengths (week-end, week, fortnight) we observe multiple peculiar spikes in its distribution. To take into account these two distinctive characteristics, we generalise the usual hurdle regression model by specifying a multiple inflated truncated negative binomial distribution for the positive responses. Results show that the economic recession impacted negatively on both components of the decision process and that, by controlling for the inflated nature of the response variable's distribution, the proposed formulation provides a better representation of the Italians' tourism behaviour in comparison with non-inflated hurdle models. Given this, we believe that our model can be a useful tool for policy makers who are trying to forecast the effects of new targeted policies to support tourism economy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)