Summary

Natural disasters, such as tornadoes, floods, and wildfire pose risks to life and property, requiring the intervention of insurance corporations. One of the most visible consequences of changing climate is an increase in the intensity and frequency of extreme weather events. The relative strengths of these disasters are far beyond the habitual seasonal maxima, often resulting in subsequent increases in property losses. Thus, insurance policies should be modified to endure increasingly volatile catastrophic weather events. We propose a Natural Disasters Index (NDI) for the property losses caused by natural disasters in the United States based on the "Storm Data" published by the National Oceanic and Atmospheric Administration. The proposed NDI is an attempt to construct a financial instrument for hedging the intrinsic risk. The NDI is intended to forecast the degree of future risk that could forewarn the insurers and corporations allowing them to transfer insurance risk to capital market investors. This index could also be modified to other regions and countries.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research proposes a Natural Disasters Index (NDI) for estimating property losses in the US due to natural disasters, using Storm Data from the National Oceanic and Atmospheric Administration (NOAA). It employs a GARCH(1,1) model with generalized hyperbolic innovations to simulate future values of NDI for option pricing and risk budgeting.

Key Results

- The NDI is constructed to forecast future risk from natural disasters, aiding insurers and corporations in transferring risk to capital market investors.

- Option prices (call and put) for the NDI are calculated at different times to maturity and strike prices using Monte Carlo simulations.

- Risk budgets, including standard deviation (Std) and expected tail loss (ETL) at 95% and 99% levels, identify tornado, tropical storm, flood, ice storm, and flash flood as major risk contributors.

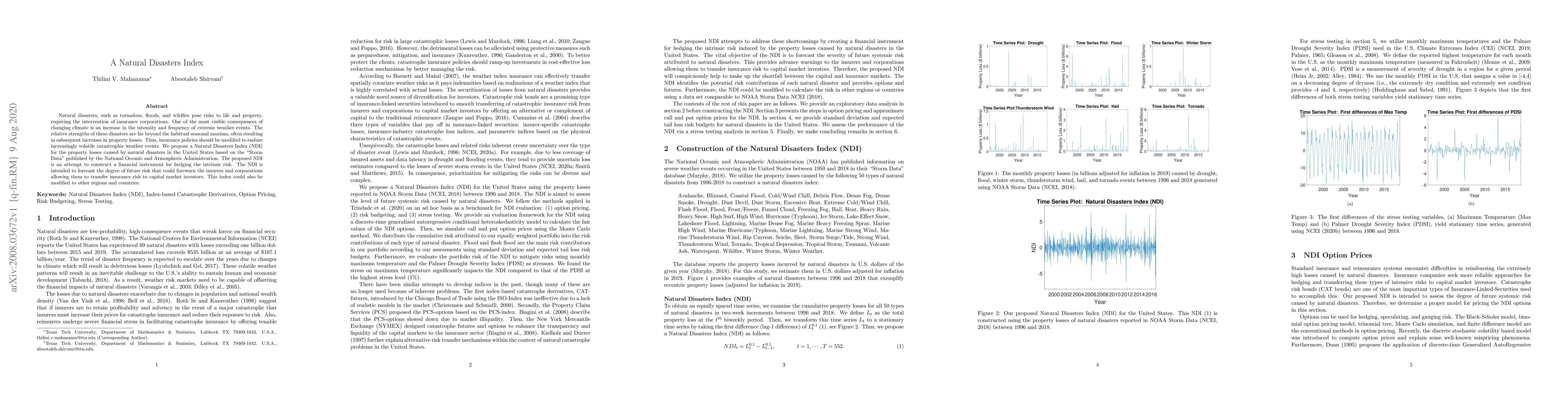

- Stress testing with monthly maximum temperature (MaxTemp) and Palmer Drought Severity Index (PDSI) reveals that stress on MaxTemp has a more significant impact on NDI at higher stress levels (1%) compared to PDSI.

Significance

This research is significant as it proposes a financial instrument (NDI) to hedge risks from property losses due to natural disasters, bridging the gap between capital and insurance markets.

Technical Contribution

The paper introduces a novel Natural Disasters Index (NDI) for quantifying property losses from natural disasters, along with methods for option pricing and risk budgeting.

Novelty

The proposed NDI, along with its associated option pricing and risk budgeting techniques, offers a unique approach to addressing the financial risks associated with natural disasters, providing a valuable tool for insurers and capital market investors.

Limitations

- The NDI is specifically constructed for the United States and may require modification for other regions or countries.

- The study assumes a discrete-time GARCH model with generalized hyperbolic innovations, which may not capture all complexities of natural disaster occurrences.

Future Work

- The NDI could be adapted for other regions using comparable datasets to NOAA Storm Data.

- Further research could explore alternative models or incorporate more sophisticated techniques to better capture the dynamics of natural disasters.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTemperature Variability and Natural Disasters

Aatishya Mohanty, Nattavudh Powdthavee, Cheng Keat Tang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)