Summary

Let X and Y be two independent and nonnegative random variables with corresponding distributions F and G. Denote by H the distribution of the product XY , called the product convolution of F and G. Cline and Samorodnitsky (1994) proposed sufficient conditions for H to be subexponential, given the subexponentiality of F. Relying on a related result of Tang (2008) on the long-tail of product convolution, we obtain a necessary and sufficient condition for the subexponentiality of H, given that of F. We also study the reverse problem and obtain sufficient conditions for the subexponentiality of F given that of H. Finally, we apply the obtained results to the asymptotic study of the ruin probability in a discrete-time insurance risk model with stochastic returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

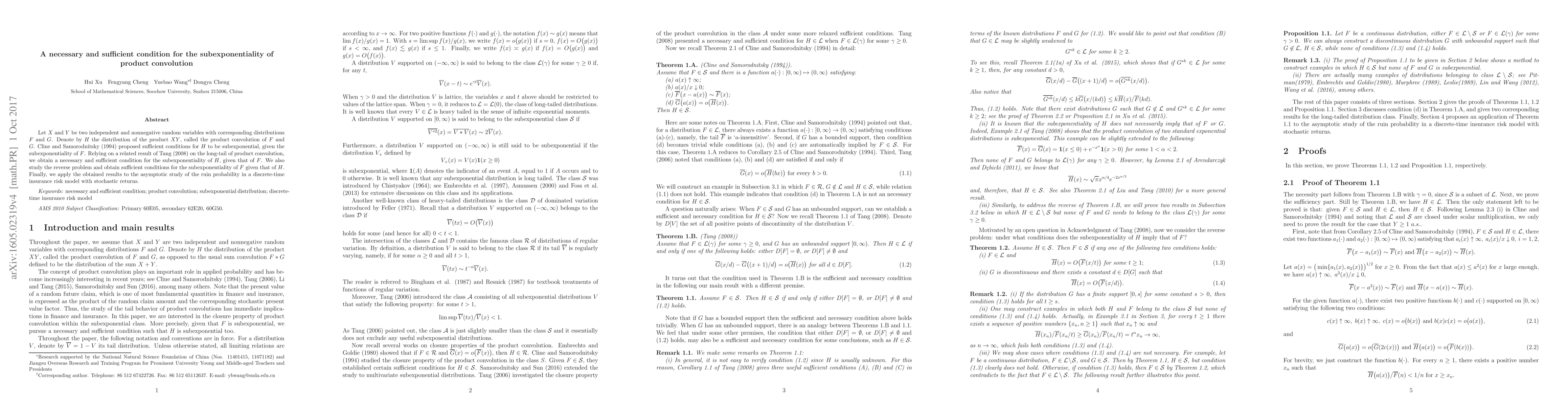

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)