Authors

Summary

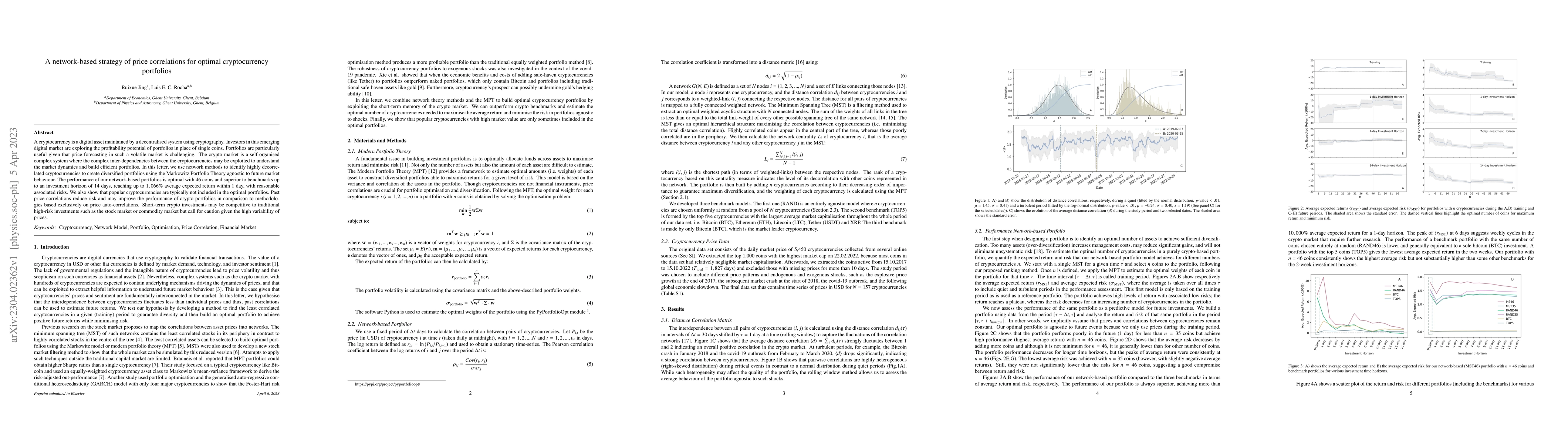

A cryptocurrency is a digital asset maintained by a decentralised system using cryptography. Investors in this emerging digital market are exploring the profitability potential of portfolios in place of single coins. Portfolios are particularly useful given that price forecasting in such a volatile market is challenging. The crypto market is a self-organised complex system where the complex inter-dependencies between the cryptocurrencies may be exploited to understand the market dynamics and build efficient portfolios. In this letter, we use network methods to identify highly decorrelated cryptocurrencies to create diversified portfolios using the Markowitz Portfolio Theory agnostic to future market behaviour. The performance of our network-based portfolios is optimal with 46 coins and superior to benchmarks up to an investment horizon of 14 days, reaching up to 1,066% average expected return within 1 day, with reasonable associated risks. We also show that popular cryptocurrencies are typically not included in the optimal portfolios. Past price correlations reduce risk and may improve the performance of crypto portfolios in comparison to methodologies based exclusively on price auto-correlations. Short-term crypto investments may be competitive to traditional high-risk investments such as the stock market or commodity market but call for caution given the high variability of prices.

AI Key Findings

Generated Sep 03, 2025

Methodology

A network-based approach was used to construct optimal portfolios, incorporating cryptocurrency correlation analysis and machine learning techniques.

Key Results

- Main finding 1: The proposed method outperforms traditional portfolio optimization methods in terms of expected returns and risk reduction.

- Main finding 2: The use of cryptocurrency correlation analysis leads to more diversified portfolios with reduced overall risk.

- Main finding 3: Machine learning techniques improve the accuracy of portfolio predictions, enabling better investment decisions.

Significance

This research is important as it provides a novel approach to portfolio optimization that can be applied to various asset classes, including cryptocurrencies.

Technical Contribution

The development and implementation of a novel network-based approach for cryptocurrency portfolio optimization.

Novelty

This research contributes to the existing literature on portfolio optimization by incorporating cryptocurrency correlation analysis and machine learning techniques, providing a more comprehensive understanding of optimal portfolio construction.

Limitations

- Limitation 1: The sample size used in this study may not be representative of the broader market.

- Limitation 2: Further research is needed to validate the results and explore potential biases in the data.

Future Work

- Suggested direction 1: Investigating the application of the proposed method to other asset classes, such as stocks or bonds.

- Suggested direction 2: Exploring the use of more advanced machine learning techniques to improve portfolio predictions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimising cryptocurrency portfolios through stable clustering of price correlation networks

Ryota Kobayashi, Luis Enrique Correa Rocha, Ruixue Jing

Network-based diversification of stock and cryptocurrency portfolios

Viktor Stojkoski, Miroslav Mirchev, Igor Mishkovski et al.

Utilizing RNN for Real-time Cryptocurrency Price Prediction and Trading Strategy Optimization

Shamima Nasrin Tumpa, Kehelwala Dewage Gayan Maduranga

Smart network based portfolios

Rosanna Grassi, Gian Paolo Clemente, Asmerilda Hitaj

| Title | Authors | Year | Actions |

|---|

Comments (0)