Authors

Summary

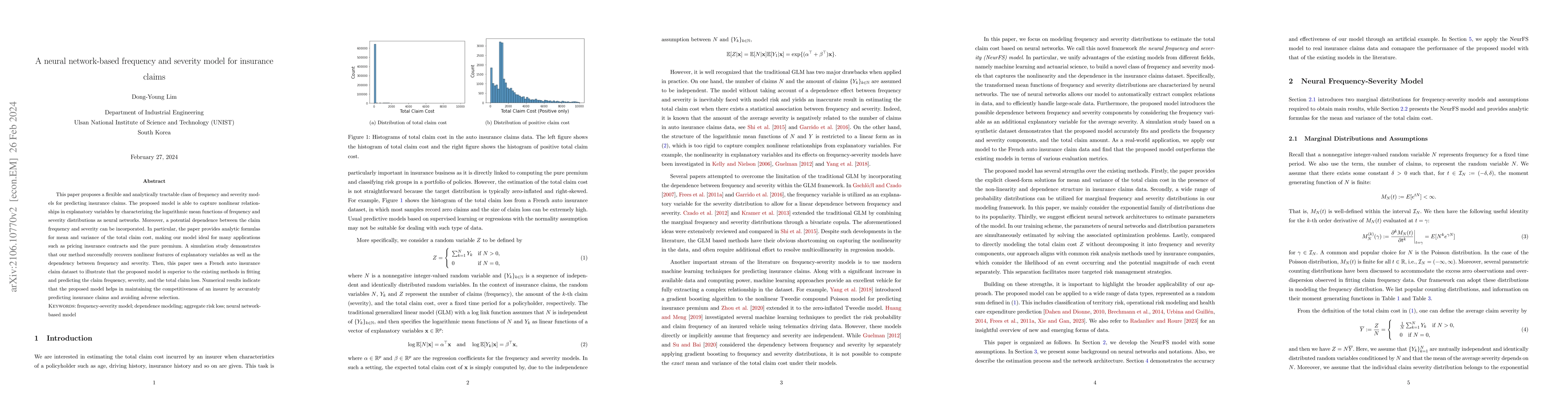

This paper proposes a flexible and analytically tractable class of frequency and severity models for predicting insurance claims. The proposed model is able to capture nonlinear relationships in explanatory variables by characterizing the logarithmic mean functions of frequency and severity distributions as neural networks. Moreover, a potential dependence between the claim frequency and severity can be incorporated. In particular, the paper provides analytic formulas for mean and variance of the total claim cost, making our model ideal for many applications such as pricing insurance contracts and the pure premium. A simulation study demonstrates that our method successfully recovers nonlinear features of explanatory variables as well as the dependency between frequency and severity. Then, this paper uses a French auto insurance claim dataset to illustrate that the proposed model is superior to the existing methods in fitting and predicting the claim frequency, severity, and the total claim loss. Numerical results indicate that the proposed model helps in maintaining the competitiveness of an insurer by accurately predicting insurance claims and avoiding adverse selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNeural networks for insurance pricing with frequency and severity data: a benchmark study from data preprocessing to technical tariff

Katrien Antonio, Freek Holvoet, Roel Henckaerts

Bayesian CART models for insurance claims frequency

Lanpeng Ji, Georgios Aivaliotis, Yaojun Zhang et al.

Modeling Insurance Claims using Bayesian Nonparametric Regression

Kaushik Ghosh, Mostafa Shams Esfand Abadi

Cyber Risk Frequency, Severity and Insurance Viability

Georgy Sofronov, Gareth W. Peters, Matteo Malavasi et al.

No citations found for this paper.

Comments (0)