Authors

Summary

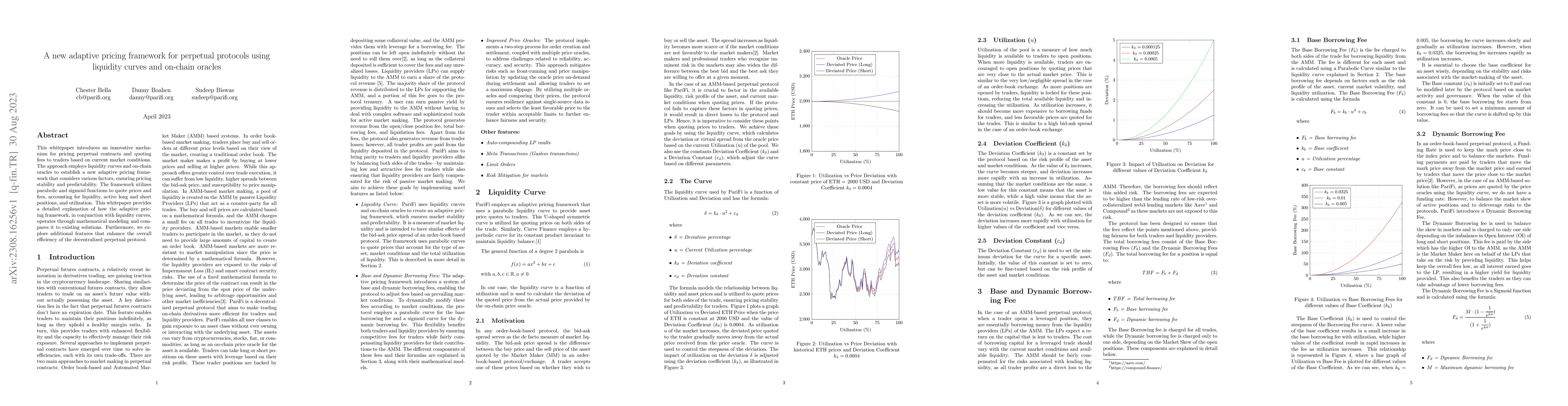

This whitepaper introduces an innovative mechanism for pricing perpetual contracts and quoting fees to traders based on current market conditions. The approach employs liquidity curves and on-chain oracles to establish a new adaptive pricing framework that considers various factors, ensuring pricing stability and predictability. The framework utilizes parabolic and sigmoid functions to quote prices and fees, accounting for liquidity, active long and short positions, and utilization. This whitepaper provides a detailed explanation of how the adaptive pricing framework, in conjunction with liquidity curves, operates through mathematical modeling and compares it to existing solutions. Furthermore, we explore additional features that enhance the overall efficiency of the decentralized perpetual protocol.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntertemporal Pricing of Time-Bound Stablecoins: Measuring and Controlling the Liquidity-of-Time Premium

Cong He, Ailiya Borjigin

Liquidity Risks in Lending Protocols: Evidence from Aave Protocol

Xiaotong Sun, Charalampos Stasinakis, Georgios Sermpinis

No citations found for this paper.

Comments (0)