Summary

We formulate a new class of stochastic partial differential equations (SPDEs), named high-order vector backward SPDEs (B-SPDEs) with jumps, which allow the high-order integral-partial differential operators into both drift and diffusion coefficients. Under certain type of Lipschitz and linear growth conditions, we develop a method to prove the existence and uniqueness of adapted solution to these B-SPDEs with jumps. Comparing with the existing discussions on conventional backward stochastic (ordinary) differential equations (BSDEs), we need to handle the differentiability of adapted triplet solution to the B-SPDEs with jumps, which is a subtle part in justifying our main results due to the inconsistency of differential orders on two sides of the B-SPDEs and the partial differential operator appeared in the diffusion coefficient. In addition, we also address the issue about the B-SPDEs under certain Markovian random environment and employ a B-SPDE with strongly nonlinear partial differential operator in the drift coefficient to illustrate the usage of our main results in finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

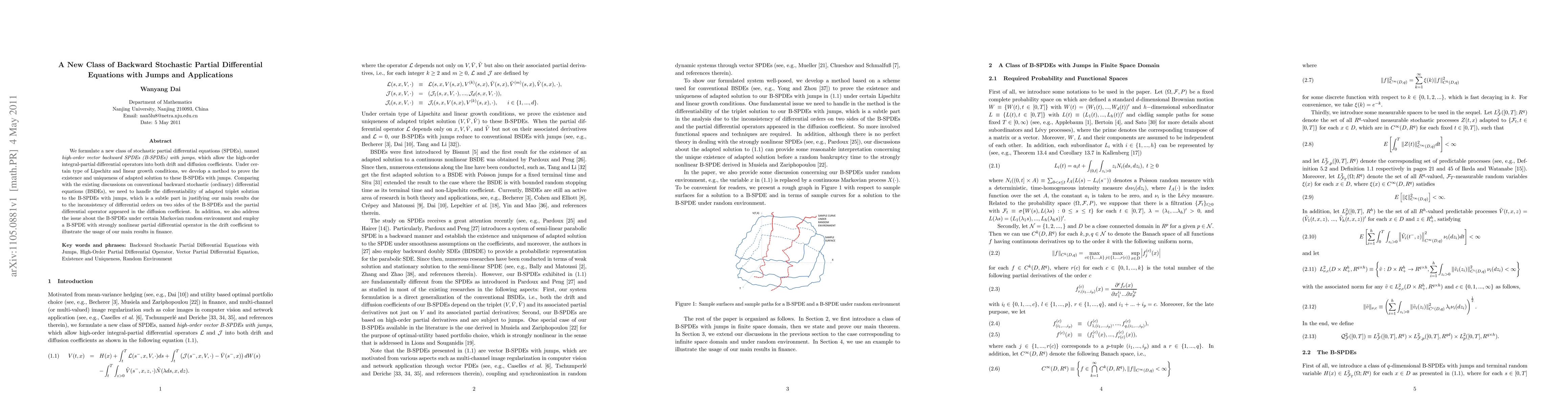

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)