Summary

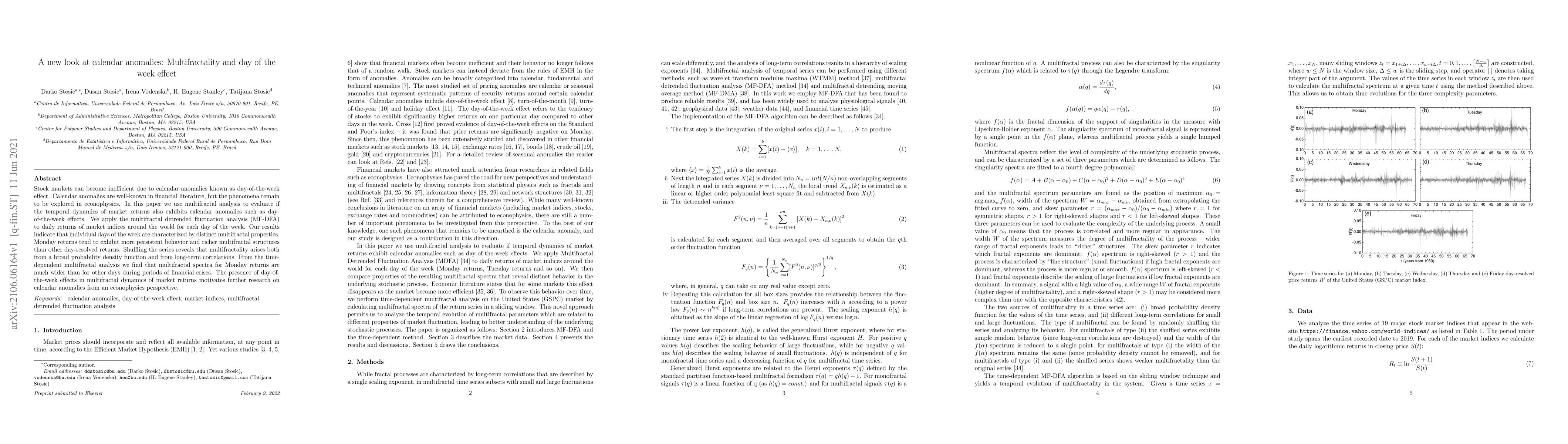

Stock markets can become inefficient due to calendar anomalies known as day-of-the-week effect. Calendar anomalies are well-known in financial literature, but the phenomena remain to be explored in econophysics. In this paper we use multifractal analysis to evaluate if the temporal dynamics of market returns also exhibits calendar anomalies such as day-of-the-week effects. We apply the multifractal detrended fluctuation analysis (MF-DFA) to daily returns of market indices around the world for each day of the week. Our results indicate that individual days of the week are characterized by distinct multifractal properties. Monday returns tend to exhibit more persistent behavior and richer multifractal structures than other day-resolved returns. Shuffling the series reveals that multifractality arises both from a broad probability density function and from long-term correlations. From the time-dependent multifractal analysis we find that multifractal spectra for Monday returns are much wider than for other days during periods of financial crises. The presence of day-of-the-week effects in multifractal dynamics of market returns motivates further research on calendar anomalies from an econophysics perspective.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)