Summary

We analyse the behaviour of the implied volatility smile for options close to expiry in the exponential L\'evy class of asset price models with jumps. We introduce a new renormalisation of the strike variable with the property that the implied volatility converges to a non-constant limiting shape, which is a function of both the diffusion component of the process and the jump activity (Blumenthal-Getoor) index of the jump component. Our limiting implied volatility formula relates the jump activity of the underlying asset price process to the short end of the implied volatility surface and sheds new light on the difference between finite and infinite variation jumps from the viewpoint of option prices: in the latter, the wings of the limiting smile are determined by the jump activity indices of the positive and negative jumps, whereas in the former, the wings have a constant model-independent slope. This result gives a theoretical justification for the preference of the infinite variation L\'evy models over the finite variation ones in the calibration based on short-maturity option prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

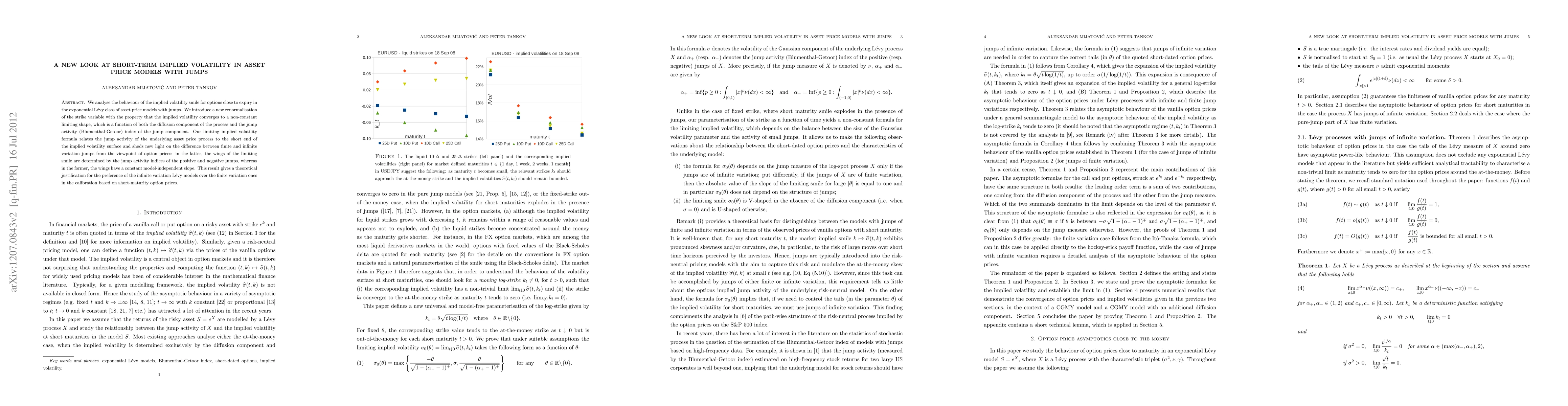

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)