Summary

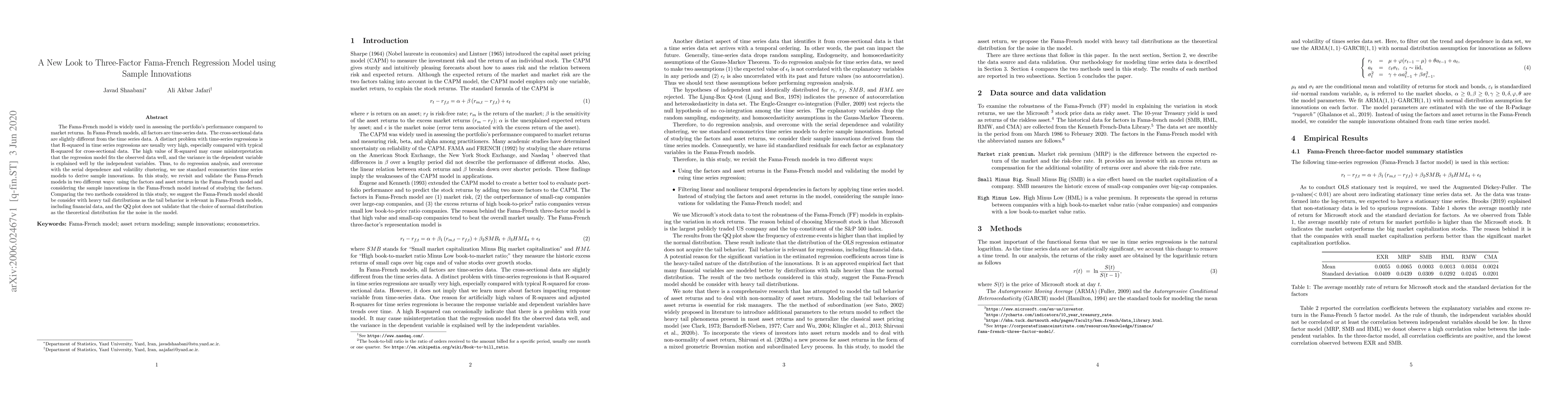

The Fama-French model is widely used in assessing the portfolio's performance compared to market returns. In Fama-French models, all factors are time-series data. The cross-sectional data are slightly different from the time series data. A distinct problem with time-series regressions is that R-squared in time series regressions is usually very high, especially compared with typical R-squared for cross-sectional data. The high value of R-squared may cause misinterpretation that the regression model fits the observed data well, and the variance in the dependent variable is explained well by the independent variables. Thus, to do regression analysis, and overcome with the serial dependence and volatility clustering, we use standard econometrics time series models to derive sample innovations. In this study, we revisit and validate the Fama-French models in two different ways: using the factors and asset returns in the Fama-French model and considering the sample innovations in the Fama-French model instead of studying the factors. Comparing the two methods considered in this study, we suggest the Fama-French model should be considered with heavy tail distributions as the tail behavior is relevant in Fama-French models, including financial data, and the QQ plot does not validate that the choice of the normal distribution as the theoretical distribution for the noise in the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForward Selection Fama-MacBeth Regression with Higher-Order Asset Pricing Factors

Denis Chetverikov, Yukun Liu, Nicola Borri et al.

Time Instability of the Fama-French Multifactor Models: An International Evidence

Koichiro Moriya, Akihiko Noda

| Title | Authors | Year | Actions |

|---|

Comments (0)