Authors

Summary

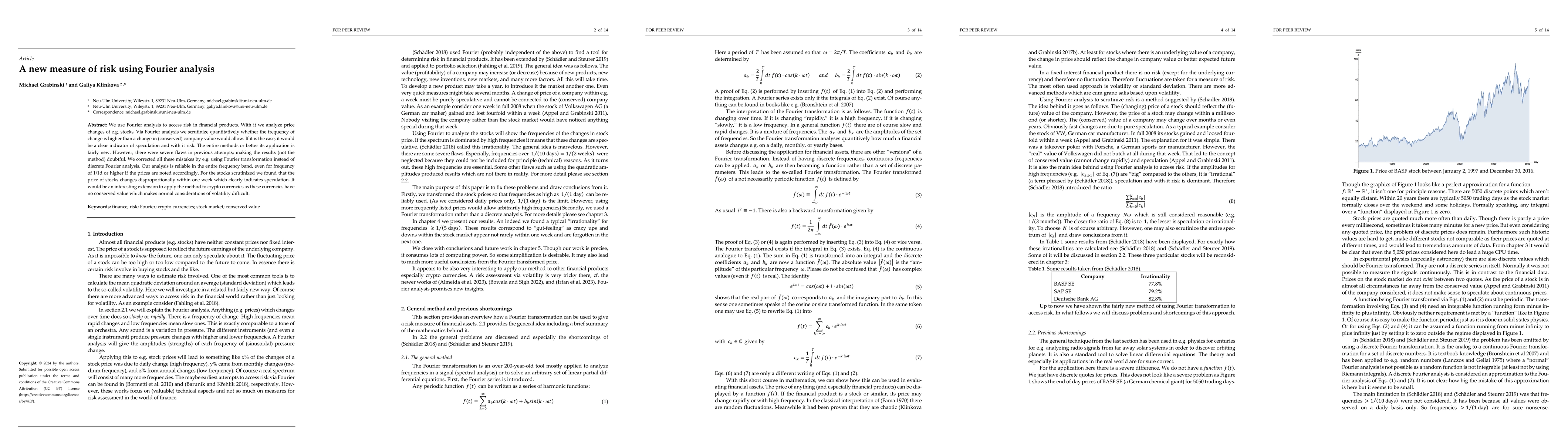

We use Fourier analysis to access risk in financial products. With it we analyze price changes of e.g. stocks. Via Fourier analysis we scrutinize quantitatively whether the frequency of change is higher than a change in (conserved) company value would allow. If it is the case, it would be a clear indicator of speculation and with it risk. The entire methods or better its application is fairly new. However, there were severe flaws in previous attempts; making the results (not the method) doubtful. We corrected all these mistakes by e.g. using Fourier transformation instead of discrete Fourier analysis. Our analysis is reliable in the entire frequency band, even for fre-quency of 1/1d or higher if the prices are noted accordingly. For the stocks scrutinized we found that the price of stocks changes disproportionally within one week which clearly indicates spec-ulation. It would be an interesting extension to apply the method to crypto currencies as these currencies have no conserved value which makes normal considerations of volatility difficult.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)