Summary

In complete markets, there are risky assets and a riskless asset. It is assumed that the riskless asset and the risky asset are traded continuously in time and that the market is frictionless. In this paper, we propose a new method for hedging derivatives assuming that a hedger should not always rely on trading existing assets that are used to form a linear portfolio comprised of the risky asset, the riskless asset, and standard derivatives, but rather should design a set of specific, most-suited financial instruments for the hedging problem. We introduce a sequence of new financial instruments best suited for hedging jump-diffusion and stochastic volatility market models. The new instruments we introduce are perpetual derivatives. More specifically, they are options with perpetual maturities. In a financial market where perpetual derivatives are introduced, there is a new set of partial and partial-integro differential equations for pricing derivatives. Our analysis demonstrates that the set of new financial instruments together with a risk measure called the tail-loss ratio measure defined by the new instrument's return series can be potentially used as an early warning system for a market crash.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

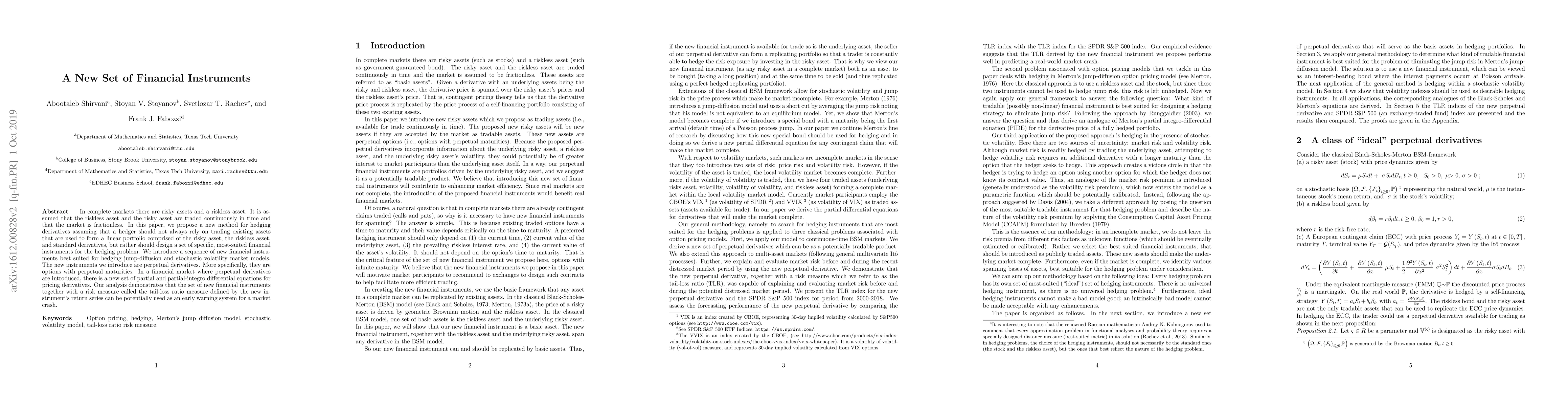

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterdependence between Green Financial Instruments and Major Conventional Assets: A Wavelet-Based Network Analysis

Vicente J. Bolos, Roman Ferrer, Rafael Benitez

| Title | Authors | Year | Actions |

|---|

Comments (0)